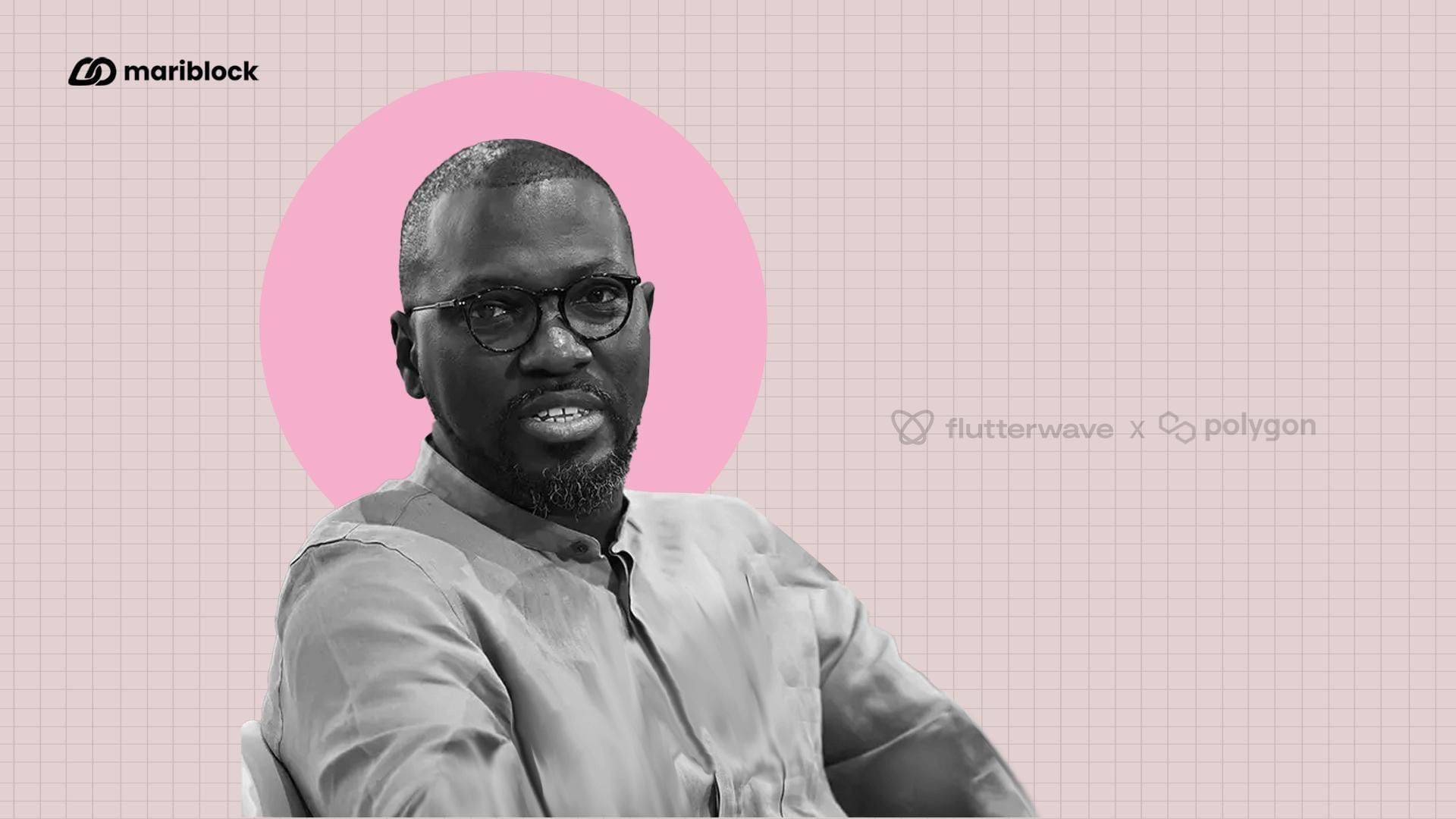

Glen Jordan, the CEO of Empowa, a fintech company that provides affordable home loans to low-income households in Africa, shared details about his company’s operational model with global industry experts.

Jordan participated as a panelist on the topic “Innovative housing building companies and financing affordable green housing for low and very low-income households” at the World Bank’s 9th Global Affordable Housing Conference on May 31, 2023.

Empowa’s rent-to-own model caters to the informal housing market in Africa.

Jordan discussed using blockchain to fund affordable housing in Mozambique via a lease-to-own model, meeting informal market needs and ensuring trustworthy feedback to investors. According to him, blockchain offers transparency, allowing investors to monitor their rent-to-own portfolio in real-time.

“We have to look outside the traditional funding models in order for funding to get to the market. We also have to enable the rent-to-own models. [There are] different models for purchasing because, by definition, informal income is erratic. …

“So, a key part around it is how do we build a platform, which Empowa is doing, to link rent to own [models] to alternative sources of capital in such a way that the flows can go back and forth cost-effectively and in a verified manner,” said Jordan.

Timestamp: (4:45 - 6:55)

Empowa is in discussions with legislators of some African countries to provide a proof of concept.

Empowa’s platform is limited to accredited investors due to regulatory compliance. Achieving full decentralization is a work in progress.

African governments face challenges in regulating decentralized cryptocurrencies, balancing risk reduction and innovation. Jordan mentioned engaging with African regulators to clarify Empowa’s blockchain use and demonstrate the solution’s viability.

“So, [we’re] talking to the legislators and the relevant parties, to say this is what we can do with the technology, give us a sandbox, give us a space to do it, let us prove what we can do and then take it forward from there. So, we’re in discussions with a number of African governments to do that,” he said.

When asked what kind of reactions Empowa is getting from regulators so far, he said:

“We are getting quite a positive response because of the demands, because of the realization of how all we are trying to achieve is cost reduction. If we can reduce cost and improve information [then] we’re achieving significant advances. So far, the response has been very positive in terms of what we’re doing.”

Timestamp (10:05)

Empowa has grown the home loan market in Mozambique by 5%.

Regarding milestones, Jordan elaborated on Empowa’s contributions to the home loan market in Mozambique. The company takes pride in fostering a strong reputation that benefits both tenants and investors alike.

“Well, just to give you an idea of what our success looks like, we started our project in Mozambique, one of the most challenging countries in terms of income levels and climate impact. In the first project, we grew the home loan market within one year by 5%, and that’s a ridiculously low base, so that’s not a massive achievement, but it indicates the kind of growth that can happen.

“50% of our lease-to-own/ rent-to-own homeowners are women, and we pushed the environmental improvement by more than 20% in terms of the impact,” he said.

Timestamp (11:00)

Empower integrates sustainability into its housing projects.

Jordan emphasized Empowa’s multifaceted sustainability approach, exemplified by their pilot project in Beira, Mozambique. The project involved constructing resilient housing to address the town’s history of losing homes to cyclones.

“In our case, sustainability is somewhat different, [because] the market today in Mozambique where our pilot project and proof of concept was initiated has been seriously cyclone impacted and during cyclone Idai in 2019, more than 80% of the housing there was eradicated.

“The point is self-built [housing] doesn’t cater for them. So, anytime a cyclone comes through, it’s back to square one. So smart sustainability is also about making it cyclone-proof.”

Timestamp (12:14 - 16:00)

Empowa vets its customers from the family unit and through expenditure instead of individual income.

Jordan highlighted that access to formal home loans varies based on location, city, and providers. Technology plays a crucial role in bridging this gap, offering opportunities like Empowa’s services. The team assesses customers’ spending habits instead of income since many loan applicants have irregular income due to informal sources, such as rent payments.

“It’s aspirational that most people are living in the best conditions that they can at the price that they can afford. So, we’re looking actually at expenditure ... rather than income because proof of income is so difficult to justify. Historically, banks and financial institutions are very individual-focused, and part of it is to look more at [the] family unit.

“So, while one person is responsible, we look more at the family. So [we ask] does one person have a job? Does one person have an income, and the rest are informal because that is actually a key criterion in the area [where] we are working at the moment, which is Mozambique,” he said.

Empowa accommodates erratic income by accepting a minimum payment and gradual tenant contributions over extended periods, enabling larger amounts over time.

Timestamp (17:00)

Partnering with local service providers makes their project cost-effective

In conclusion, Jordan shared that Empowa maintains its customer relationships and ensures project cost-effectiveness and affordability through strong partnerships with local service providers near the customers.

“A key part is around the service provider being as close to the customer as possible … The further removed you get, the more communication challenges and the higher the cost associated with that,” he said.

Timestamp (20:30)