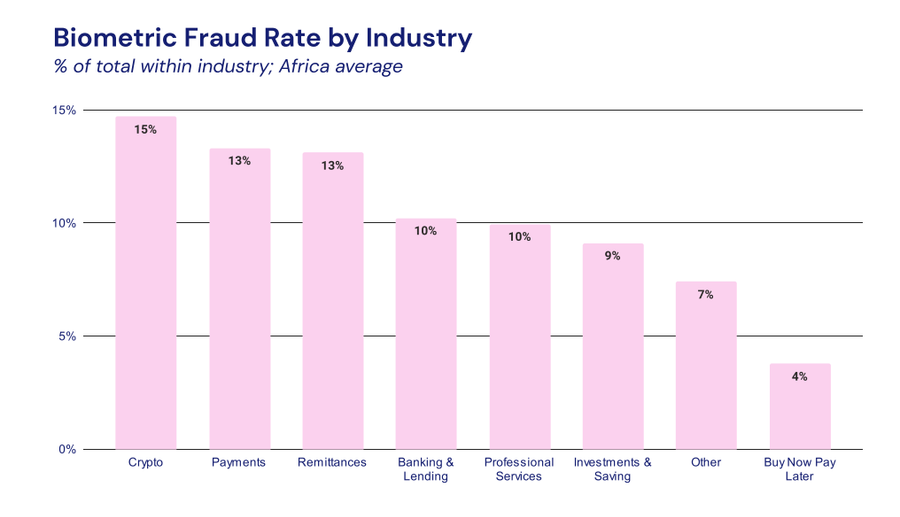

Crypto is responsible for the highest biometric fraud rate of all industries in Africa. However, digital identity (DID) might be the solution. That’s according to a new report from Nigerian digital identity company Smile ID.

This comes amidst controversies around DIDs resulting from the launch of Worldcoin.

The details

- In its “State of KYC in Africa” report, Smile ID said 15% of all biometric frauds its system witnessed in the first half of 2023 were in the crypto space.

- According to the company, these frauds are rampant in cases where the crypto and the remittance industries exclusively rely on textual checks such as government-issued ID cards.

- Solution: Smile ID says biometric digital identity systems can help prevent fraud and establish trust, as they are more challenging to fake than traditional text-based ID methods.

Source: Smile ID

Key quotes

“By incorporating biometric verification methods, businesses can enhance their security measures, better detect fraudulent activities, and protect their platforms and users. As the payments and remittances industries continue to grow in Africa, integrating biometric solutions will be crucial for maintaining trust and ensuring the safety of transactions within these sectors.”

- Smile ID produces its State of KYC report largely based on data generated from its own operations.

The tilt

- The notion of DID systems in Africa has become unpopular following the launch of Worldcoin, a project founded by ChatGPT founder Sam Altman.

- Worldcoin set out to build a decentralized and global proof-of-personhood digital identity network relying on biometric data from iris scans. The project uses these scans to issue unique digital IDs on a blockchain for transparency.

- During a Twitter Space hosted by Mariblock, president of the Blockchain Association of Kenya, Michael Kimani said Worldcoin’s project could bridge the ID gap in Africa and let more Africans access financial services at a global level.

- He added that Worldcoin’s blockchain-based ID system could help establish trust between two players in a business transaction in different countries. This would reduce fraud and open more economic opportunities for Africans.

- Kimani said:

“For me, the Worldcoin project is trying to address this gap; how can you open up financial opportunities on the internet that have been previously locked out for underserved users [in Africa] … The current government ID structure that we have in some African countries is really limited, almost as if there is an issue of trust .”

- However, after Worldcoin’s launch, security, and privacy concerns have trailed its biometric digital ID drive.

- After making a solid start in Kenya, the government of Kenya suspended its activities over security, authenticity and legality issues around the company’s activities in the country.

- The release banning its activities read:

“The government has suspended forthwith, the activities of ‘World Coin’ and any other entity that may be similarly engaging the people of Kenya until relevant public agencies certify the absence of any risks to the general public whatsoever.”

Editor’s note: This story has been edited for clarity. An earlier version of the story excluded quotes from the report about how digital IDs can help fight KYC fraud. That has now been included. The headline, lede and body have also been modified to include additional information from the report.