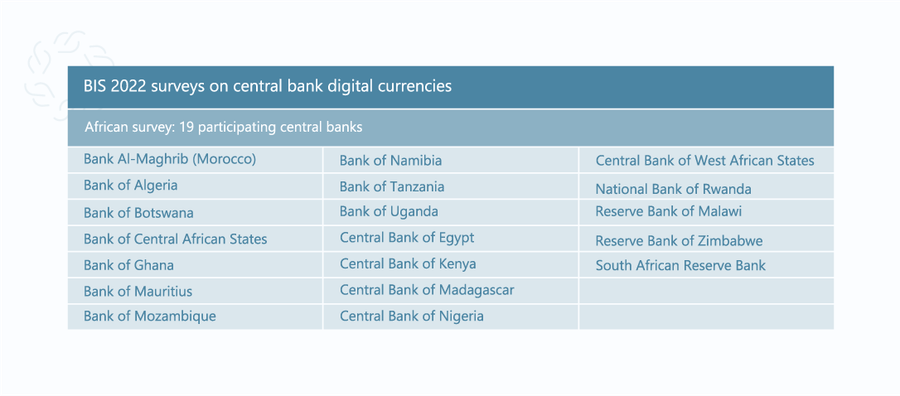

Many African central banks have shown interest in or are developing Central Bank Digital Currencies (CBDC), according to a recent report by the Bank for International Settlements (BIS). The study, which collected data from 19 central banks in the region, showed that the motivations differed from those in other areas.

Table by Ifeoluwa Awowoye exclusively for Mariblock.

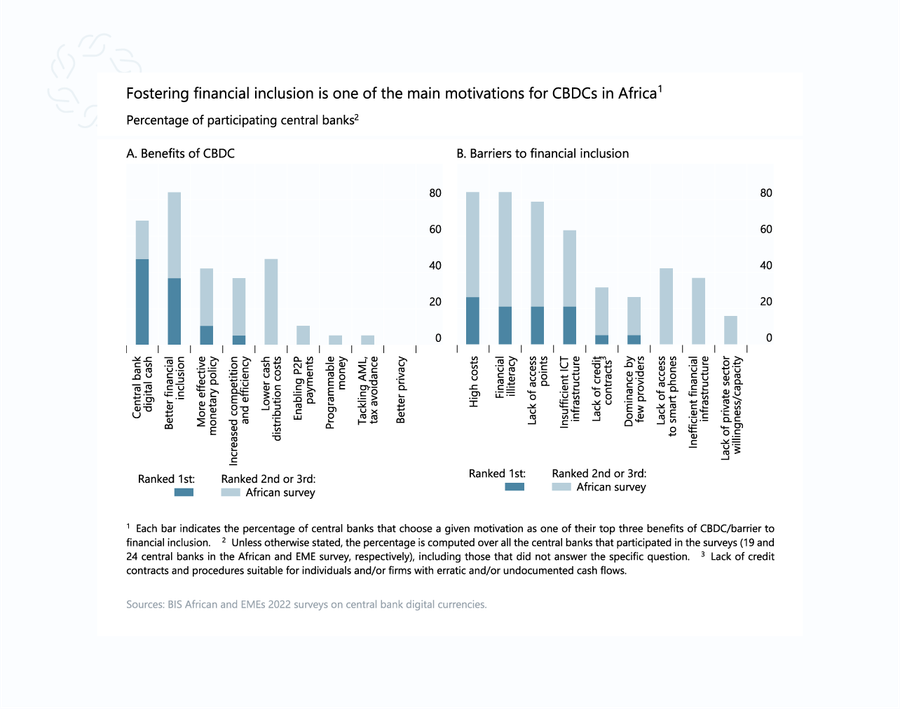

African CBDC motivations

- While better financial inclusion has been touted as one of the potential benefits of CBDCs, it didn’t rank as the most popular reason behind digital fiats projects on the continent.

- Countries with significant mobile money adoption have already solved the financial inclusion puzzle for the most part.

- For example, Kenya’s mobile money M-Pesa has provided the unbanked population with access to basic bank-like facilities via SMS services and has become universal in the country.

- Just over 33% of the respondents regard financial inclusion as the top motivation for issuing a CBDC.

Graphical illustration by Ifeoluwa Awowoye exclusively for Mariblock.

- More than half of the surveyed central banks said the ability to provide cash in a digital form was the leading consideration for exploring CBDC.

- Low cash distribution cost also ranked highly as a motivation, with 48% of the respondents seeing CBDC as a way to reduce physical cash circulation. According to them, a CBDC would save money on the printing, transportation and storage of banknotes and coins.

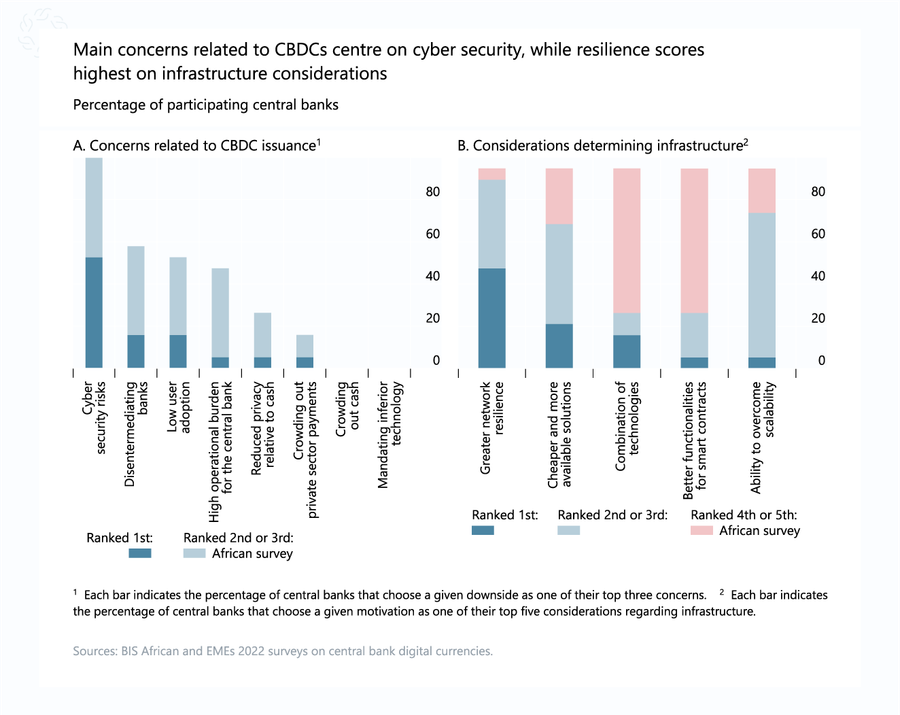

Graphical illustration by Ifeoluwa Awowoye exclusively for Mariblock.

Still, there are operational concerns

- Cybersecurity threats, bank disintermediation and low adoption were the top three worries African central banks have regarding issuing CBDCs.

- BIS, however, noted that design decisions, such as the type of CBDC adopted and the architecture of choice, can help mitigate these concerns.

Who has issued CBDC in Africa?

- Nigeria is the only African country to have issued a CBDC — and only the second globally. The Nigerian CBDC has struggled with adoption since its release in October 2021, with just $10 million in transaction volume, 840,000 downloads and 270,000 active wallets 10 months after its launch. This is despite Nigeria being Africa’s biggest business hub, with billions of dollars transacted every year and over 200 million citizens

- However, Dr. Kingsley Obiora, the Central Bank of Nigeria’s deputy governor for economic policy, told Mariblock that the eNaira project is where it is by design, adding that it’s still only in its pilot phase.

- South Africa and Ghana are currently piloting their own CBDCs, while other countries are still in the research phase of their CBDC program. Ghana’s digital fiat is unlikely to be built on blockchain.