African cryptocurrency startup Canza Finance says it has closed a $2.3 million strategic funding round to support the development of its decentralized finance (DeFi) infrastructure, starting with its flagship stablecoin exchange, Baki.

Fast facts

- Polychain Capital led the round. Other investors include Protocol Labs (which also invested in the startup’s seed round), Avalanche’s Blizzard fund, 99 Capital, Stratified Capital and Hyperithm.

- The company declined to comment on its valuation.

- The latest round takes Canza’s total funding to roughly $5.57 million.

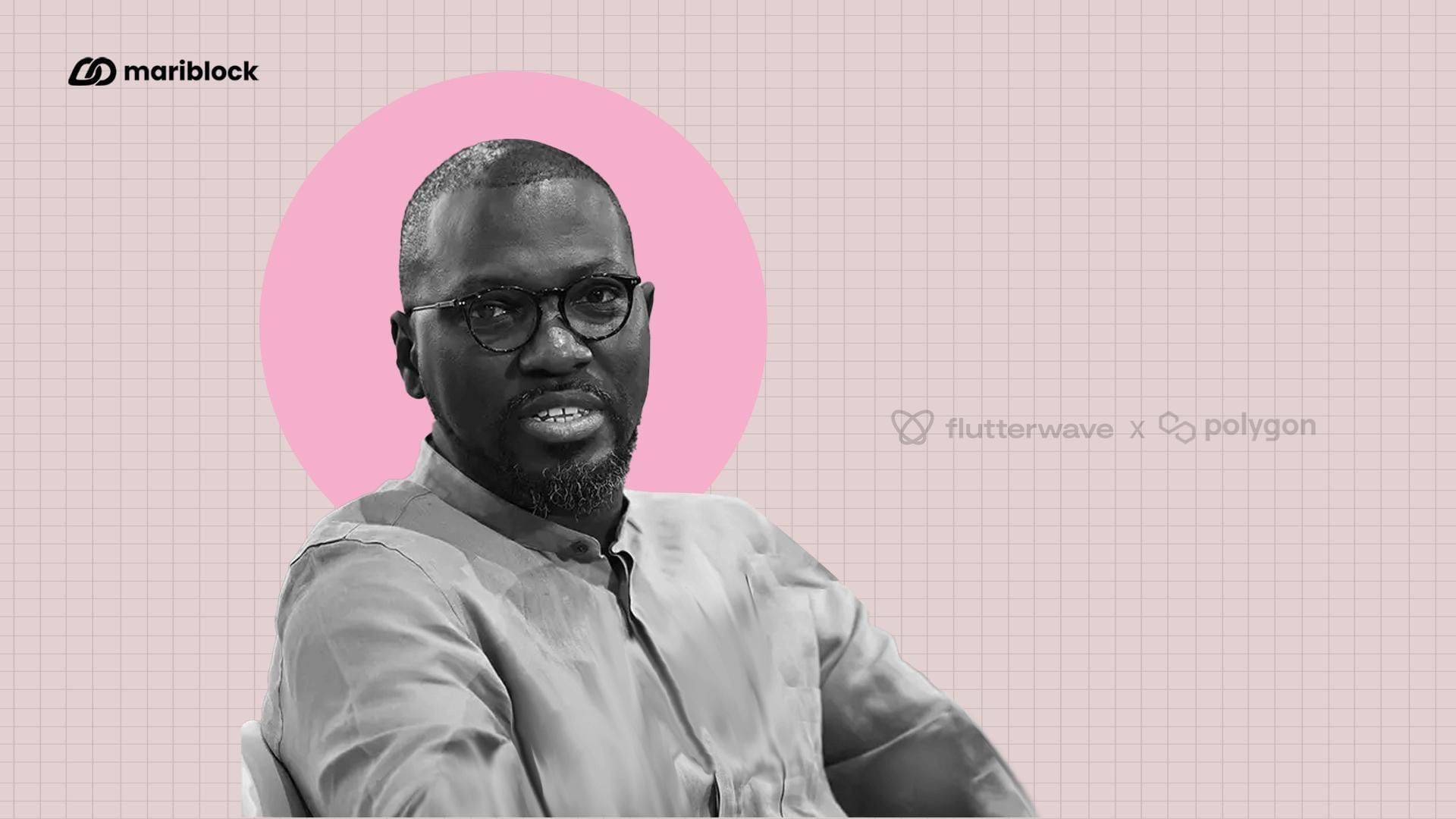

- This announcement comes nearly two years after the company, co-founded by former AT&T employees Pascal Ntsama and Oyedeji Oluwole, raised a seed round worth $3.27 million.

Key quote

“We aim to significantly boost infrastructure development, particularly in Africa. With over 50 countries on the continent, our focus is on expanding infrastructure and obtaining necessary licenses in suitable jurisdictions. Additionally, we will drive the growth of our DeFi infrastructure products,” says Co-Founder and Chief Technology Officer Oyedeji Oluwoye in a press release shared with Mariblock.

The scoop

- CTO Oluwoye tells Mariblock that Nigeria, Cameroon, Senegal and the United States are his company’s biggest markets.

- He adds that most trades Canza facilitates are in the Africa-Asia and Africa-Middle East corridors.

Dive deeper

Canza Finance’s pitch has always been to make African cross-border settlement more efficient. At launch, it set out to help African businesses, many of whom struggled to access foreign exchange, to settle international trades via crypto.

- The startup worked with on- and off-ramp partners in different countries to help businesses and local foreign exchange agents (colloquially referred to as Aboki) settle payments for goods and services.

- For example, a merchant who imports iPhones in Computer Village, Lagos, Nigeria, could use Canza to pay his supplier in Dubai.

- Canza would collect naira in Nigeria, on-ramps to stablecoin, and send it to its off-ramp partner in Dubai. The off-ramp partner then pays the supplier in fiat.

- However, Canza isn’t the only crypto entity offering this service. Transactions of this nature dominate the obscure over-the-counter markets across the continent.

- Helicarrier, the parent company of the now-defunct crypto exchange Buycoins Pro, also offers a cross-border settlement service called Desk.

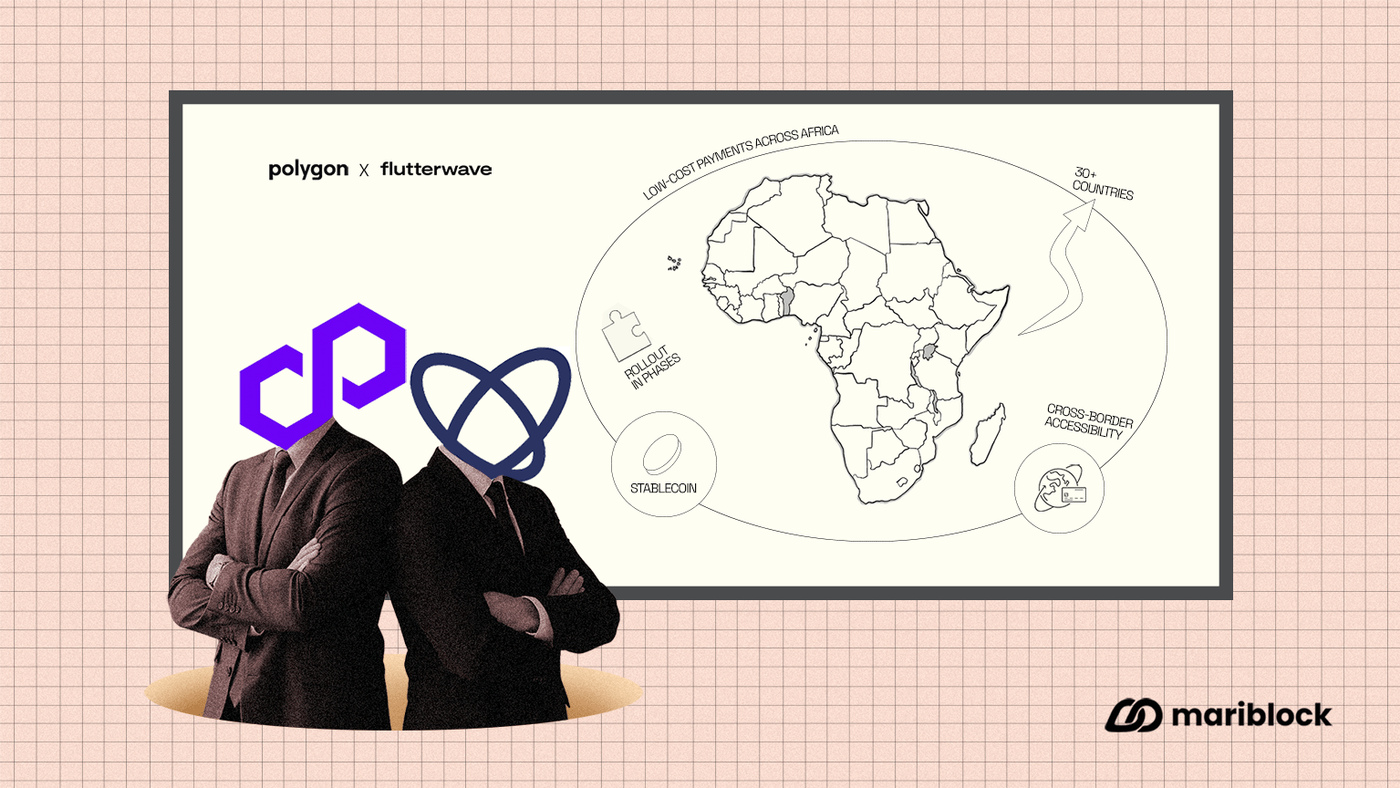

With the strategic funding, Canza seeks to bring even better efficiency to Africa’s forex market through Baki. Although stablecoins such as tether (USDT) and USD coin (USDC) provide liquidity, the exchange rates are typically in line with parallel market rates, which, in Nigeria’s case, are much higher than the official rate.

- With Baki, a DeFi protocol, the startup seeks to solve the liquidity and exchange rate disparity challenges African businesses face.

- Canza says Baki facilitates swaps between African currencies.

“The protocol allows users to deposit stable coins and mint overcollateralized, synthetic assets, called zTokens, that are pegged to African currencies, creating the first on-chain implementation of African stablecoins,” according to the Baki [website].

- Essentially, the company hopes businesses conducting trades across Africa would use Baki to port to other African currencies for payment purposes — without paying hefty fees.

Blurry lines

One major challenge the company would face is acceptance. With Baki, Canza is betting that entities would be willing to provide on- and off-ramp services between fiat and its synthetic tokens — zNGN for naira, zCFA for West African CFA and zZAR for South African rand.

- Little is known of how the company plans to drive adoption, especially in the face of mixed regulatory stances across the continent.

- CTO Oluwoye, however, told Marblock that it has registered institutional interest.