ℹ️ This article was originally published by Founders Factory Africa

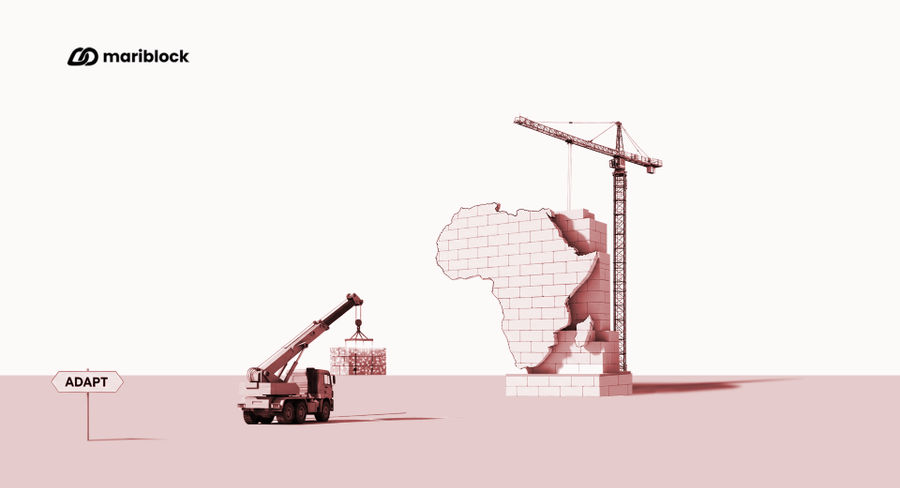

Africa’s unhealthy dependence on the United States dollar (USD) for cross-border trade is fueling an arms race for digital currency alternatives. To put this in perspective, close to half of Africa’s trade is settled in dollars.

So every year, Africa loses $5 billion in associated costs for settling trades in USD and United States bank schemes. Sometimes these trades are between neighboring African countries or economic zones. Other times it is with partners offshore.

By 2019, extra-Africa trade to China and Asia Pacific, Europe and intra-African trade was responsible for over 60% of Africa’s final destination for goods and services.

But when it comes to the final destination of payment flows, the U.S. reigns supreme, even though in 2019, the U.S. only made up less than a tenth of Africa’s total trade.

USD or bust? Africa is not standing idle

This mismatch between commercial and financial payment flows heavily favors the USD at the expense of other currencies, including local African currencies. In order to boost the efficiency and profitability of cross-border trade, Africa must come to terms with the economic costs of settling billions of payments in USD.

But who or what will replace the dollar?

A cluster of digital currency options (real and proposed) has lined up to deepen the conversation. In no particular order:

- China’s digital currency, the e-CNY, by the People’s Bank of China (PBOC)

- Central bank digital currencies (CBDCs) by African countries, such as the Central Bank of Nigeria’s eNaira,

- Digital currencies by regional economic communities (RECs), such as the proposed Eco from ECOWAS

- Non-sovereign decentralized cryptocurrencies like Bitcoin

China’s digital currency, the e-CNY, is the strongest contender for a piece of the payment flows between China, Asia Pacific and Africa.

As 2020 approached, approximately 4 out of every 10 trades in Africa’s total trade flowed through the China-Asia Pacific corridor, 5 times more than the US. Even though China is Africa’s largest trading partner, only 7% of global foreign exchange transactions by turnover involved the Chinese Yuan. As of April 2022, the Yuan trailed the USD, Euro, British Pound and Japanese Yen, with the USD involved in a staggering 88.5% of total global foreign exchange turnover.

However, with China at the forefront of the global race to develop CBDCs, Beijing’s odds look vastly better in Africa, where it can pull on its decades-old influence and more recent economic power. There are over 10,000 Chinese companies operating across the continent, with these firms having made over USD 300 billion in investments.

China’s dominance in Africa’s technology landscape is well documented. Six out of every ten smartphones in Africa are manufactured by Chinese companies like Transsion and Huawei, who are also responsible for 30% of Africa’s 3G network and 70% of its 4G network. Furthermore, between 2010 and 2017, a third of the continent’s power grid and infrastructure was constructed by Chinese state-owned firms.

Given this level of investment, with the long game firmly in mind, it came as no surprise to observers when Huawei launched the Huawei Mate 40 series with an embedded chip running China’s e-CNY wallet.

These developments have been backed by two decades of loans and grants from Beijing that have indebted African countries to China. One could argue that the Chinese Yuan is already a common currency, just indirectly.

Since 2012, Yuan-denominated financial flows in the Africa-China-Asia Pacific corridor and has grown steadily year-on-year. For example, three banks in Zambia, South Africa and Mauritius have correspondent settlement banks, while Angola and Zambia and nine others have appointed legal tender status to the Yuan.

With the Belt and Road Initiative (BRI) increasingly connecting Africa to China, the China-Asia Pacific corridor is a more than ideal test case for the digital Yuan to act as a bridge to financial flows. Movement from the continent’s central banks concerning CBDCs arguably makes China’s investment into the continent over the last 20 years even more prescient.