ℹ️ Editor’s note: This story is part of Mariblock’s “State of Fiat” coverage. Digital assets such as bitcoin are seen as competitors to central bank money. Therefore, we consider informing our audience of the state of their local currencies worthwhile.

Leading state banks in Egypt, Banque Misr and the National Bank of Egypt recently introduced two new types of dollar-denominated savings certificates, with returns to be paid on a monthly, quarterly, or annual basis.

Quick facts

- These certificates are valid for three years and available to Egyptian nationals or foreigners with a minimum deposit of $1000.

- The banks offer returns of either 9% per annum to be paid upfront in Egyptian pounds, or a 7% annual rate to be paid quarterly in dollars.

- Amidst a national foreign currency deficit, Egypt is seeking funds to resolve a backlog of demands from importers and businesses.

- The North African country also seeks to ease pressure on the Egyptian pound, which is currently trading at around 38 per $1 in the black market, a significant premium over the 30.9 it trades at in banks.

Back story

- Egypt’s central bank devalued the pound more than twice in March 2022, to secure a $3 billion deal with the International Monetary Fund (IMF).

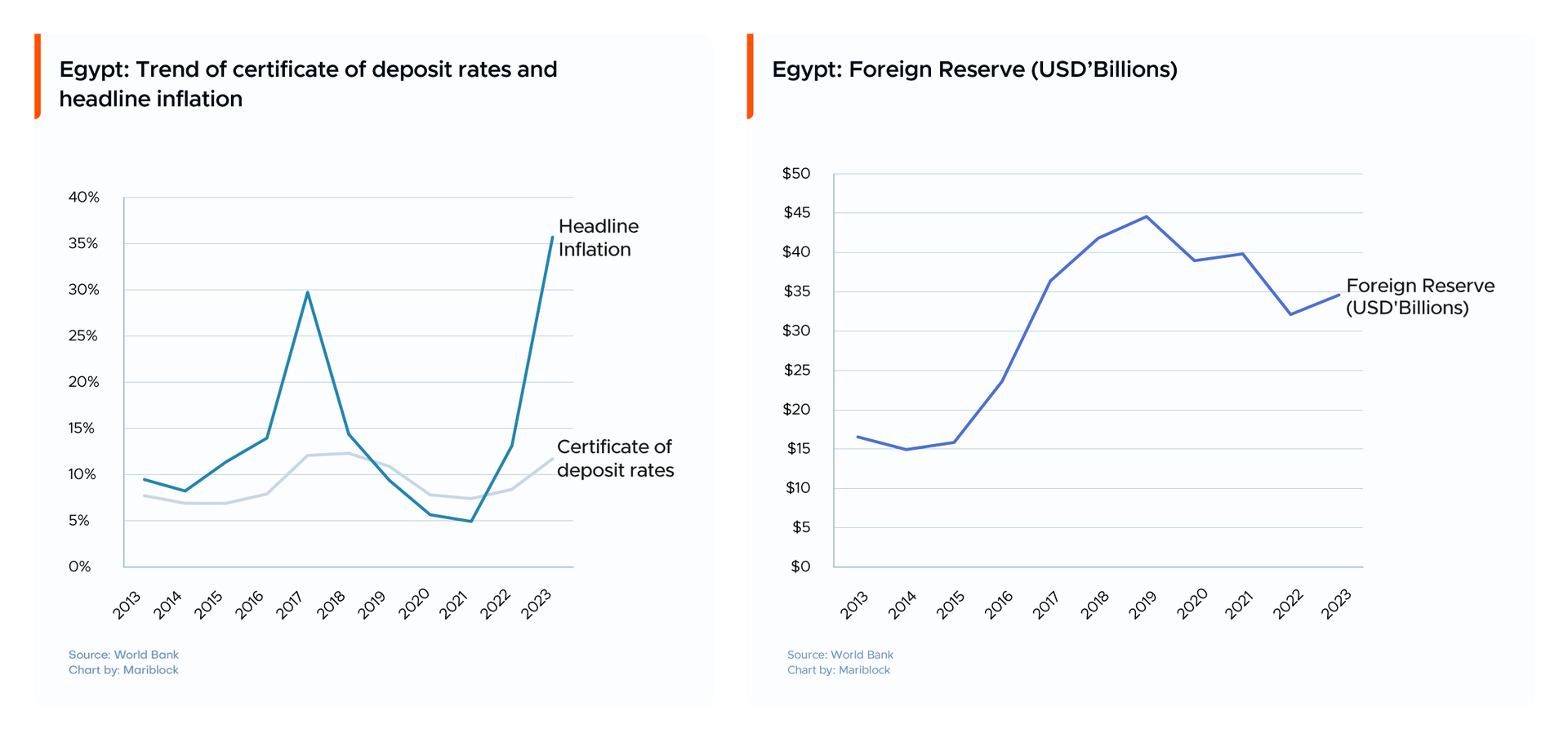

- Inflationary pressure due to the Russian-Ukraine conflict heavily affected the country’s foreign reserves, pushing the state-owned banks to offer high-interest savings certificates.

- Compared to the interest rates the new certificates offer, the average return rate for fixed savings in Egypt currently stands at 12%. This is an unattractive savings option for citizens due to the hiking inflation rate, which rose to 36% in July 2023.

Mariblock

The tilt

- Burdened by FX shortfalls, African countries have been looking for innovative ways to attract foreign investors with high yields. However, those mouth-watering returns tend to come at with a considerable amount of risk.

- For example, in Ghana, the government issued international bonds to investors, promising high yields. However, the results fell short of expectations.

- In November 2023, Ghana asked holders of its international bonds to accept losses of as much as 30% on the principal and forgo some interest payments, as it sought a debt-sustainable restructuring plan to qualify for a loan from the IMF.

- As Ghana’s economic challenges have had a negative impact on its capital market, Egypt's government may also struggle to repay investors if its economic woes do not improve.