Big Four firm KPMG has encouraged Nigerian financial institutions to embrace blockchain technology and collaborate with cryptocurrency firms instead of keeping them at a distance.

The professional services company believes that a collaboration between crypto firms and traditional banks can help both sides overcome their limitations.

The details

- In a joint publication with blockchain analytics firm Chainalysis, KPMG highlighted the unintended consequences of the Central Bank of Nigeria’s (CBN) 2021 ban on banks facilitating crypto transactions.

- The article cited insights from Chainalysis to demonstrate that the ban did not curb crypto adoption in Nigeria. Instead, the country’s share of global crypto inflows has grown since 2021.

Crypto thrived anyway

“Despite the CBN ban, Chainalysis publishes a study noting that Nigeria’s crypto transaction volume had a 9.0% year-on-year (YoY) growth rate, making it one of only six(6) countries to achieve YoY growth between June 2022 and July 2023,” the report noted.

KPMG’s suggestion

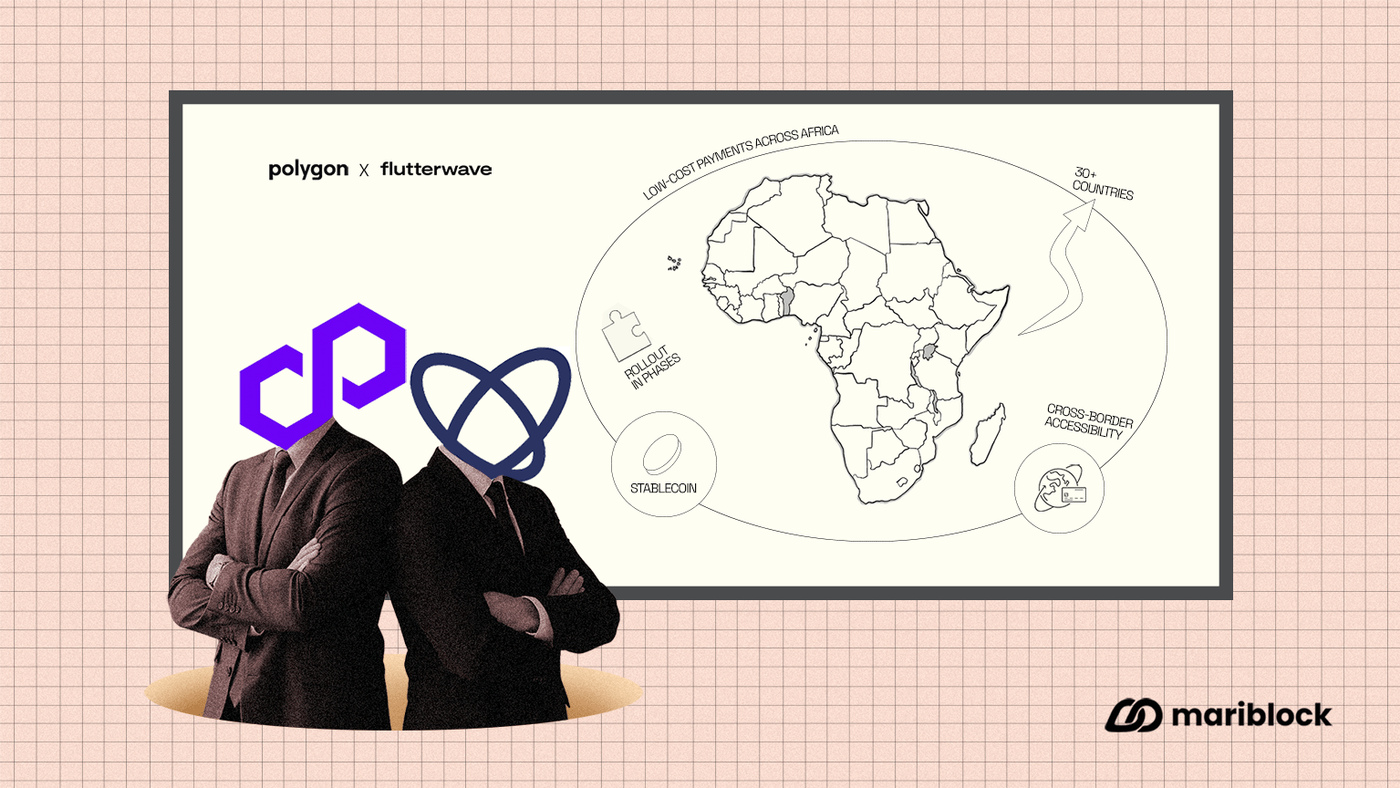

- KPMG said the recent shift towards regulation and integration could offer advantages for traditional banks and crypto companies.

- According to the firm, banks gain much-needed exposure to technological innovation by collaborating with blockchain companies and products.

- It encouraged financial institutions to maximize blockchain technology’s capacity to improve legacy monitoring systems with one that “far exceeds traditional monitoring capabilities.”

- Conversely, crypto exchanges can benefit from the expertise of traditional institutions in risk management to enhance their financial integrity and strengthen anti-money laundering controls.

Key quotes

- The report reads:

“The integration of traditional banking services with crypto firms creates a symbiotic cycle – banks gain exposure to technological innovation while bringing their institutional risk management expertise to the sector.”

- On what traditional banks stood to gain from blockchain technology, it added:

“By integrating blockchain analytics into their compliance frameworks, forward-thinking banks and other financial institutions would enhance their ability to detect illicit finance, expand into new financial services, and position themselves at the forefront of an increasingly digital financial system.”

Why it matters

- Crypto inflows into Nigeria dipped in 2022 and 2023, but this followed global market trends rather than being a direct consequence of the CBN’s ban.

- Despite restrictions, peer-to-peer (P2P) trading flourished, making Nigeria one of the leading crypto markets globally.

- In December 2023, the CBN reversed its stance, allowing banks to serve licensed crypto firms.

- Six months later, the Nigerian Securities and Exchange Commission (SEC) expanded its Accelerated Regulatory Incubation Program (ARIP) sandbox to include crypto firms, issuing provisional licenses to two local exchanges —Busha and Quidax.