MANSA Finance, a stablecoin liquidity provider for cross-border remittance companies in emerging markets, has secured $10 million in its latest funding round.

The funding will fuel its expansion into Latin America and Southeast Asia.

Driving the news

- In a press release, the company said it raised $3 million in a funding round led by the stablecoin issuer, Tether and Polymorphic Capital.

- Other investors in the round include Faculty Group, Octerra Capital and Trive Digital.

- MANSA raised an additional $7 million in liquidity from other individual investors, investment firms and funds.

Key quote

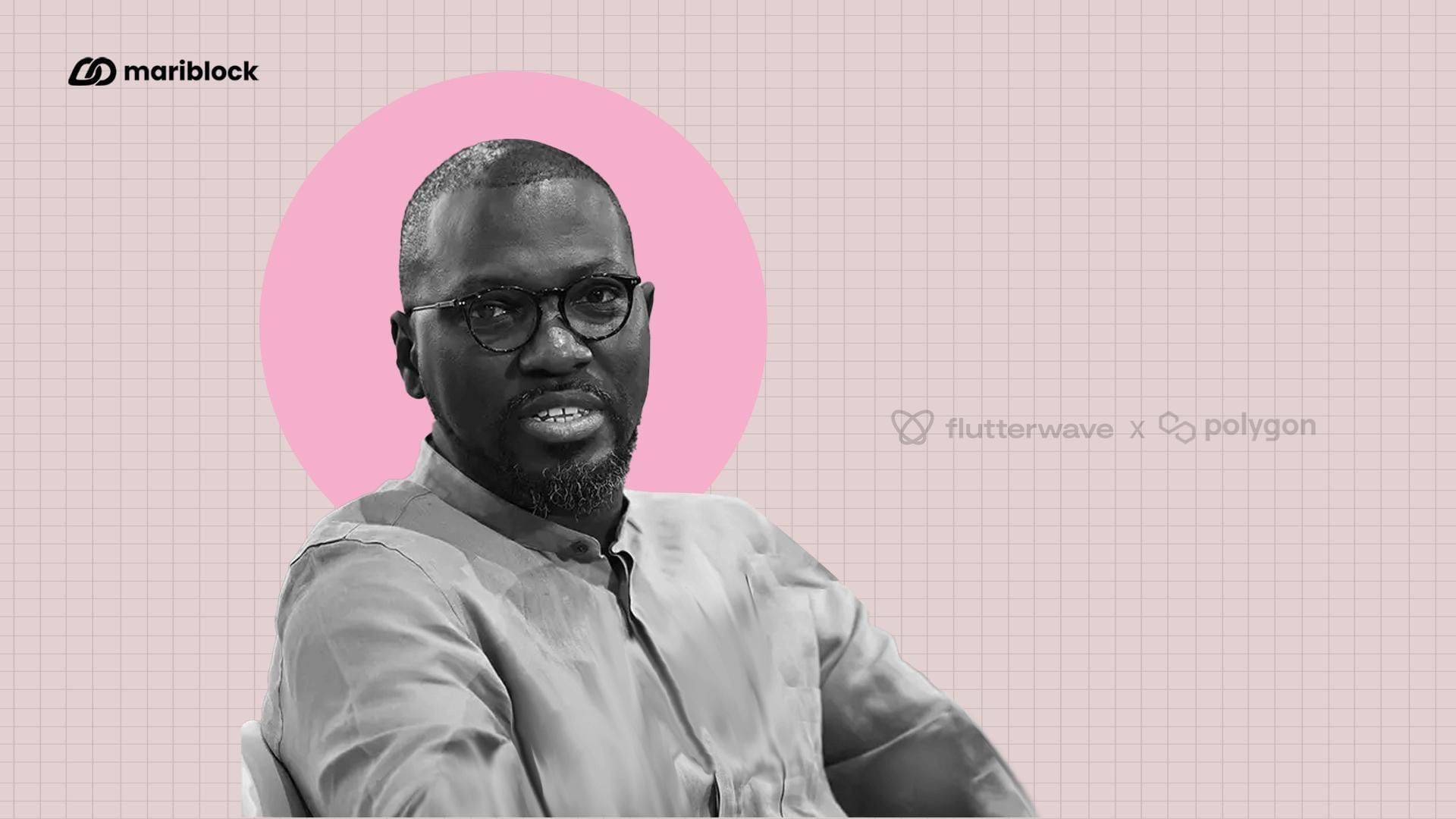

- Mouloukou Sanoh, CEO and Co-Founder of MANSA said;

“Securing $10 million in pre-seed and liquidity funding marks a significant milestone in our mission to transform the way money moves ... This funding accelerates our global expansion, enabling us to empower payment companies with seamless, real-time settlement infrastructure and drive the future of payments.”

- Paolo Ardoino, Tether’s CEO, commenting on the development, said:

“MANSA’s vision for addressing liquidity challenges in cross-border payments aligns with our mission to create a more efficient and inclusive financial system. By leveraging USDT for real-time settlements and instant payouts, MANSA is solving critical pain points for payment companies operating in emerging markets. We are proud to collaborate with MANSA and support their efforts to reshape global payment infrastructure.”

How MANSA works

- MANSA’s platform enables fintech companies in emerging markets like Africa to move funds across borders seamlessly and settle international transactions faster.

- Headquartered in the UAE with a strong presence in Africa, MANSA aims to tackle the liquidity challenges that hinder African companies from conducting seamless cross-border payments.

- MANSA sources liquidity from DeFi pools and investment funds, hosting its liquidity pool on Ethereum’s Layer-2 network, Base. It also allows companies to use various assets as collateral for loans.

- Since its launch in August, MANSA has processed $27 million in on-chain cross-border payments.

- It has also partnered with a few companies in Africa, Asia and South America, including the African cryptocurrency exchange and crossborder payments platform, Bitmama.

Zoom out

- Historically, cross-border payments have been inefficient, costly and time-consuming in Africa.

- Despite being the largest recipient of remittances in 2023, the region remains the most expensive for sending money, with an average transfer cost of 7.73%.

- USD-pegged stablecoins have gained traction as a solution for cross-border payments, offering stability and seamless transactions due to crypto’s borderless nature.

- Before MANSA, African companies such as Yellow Card and Accrue use stablecoins to settle transactions across borders albeit via different models.

- For instance, instead of pre-funded accounts, Accrue uses local agents in African countries to settle payments while holding stablecoin reserves as escrow.