South Africa gets serious about crypto crime

Omowunmi Babalola / Mariblock

Topline: South Africa’s Financial Intelligence Center (FIC) has cautioned the country’s virtual asset service providers (VASPs) to tighten controls against criminal exploitation. (Details)

Key details: In a report released on April 1 (no, not an April Fool’s joke!), the FIC found that criminals are getting sneakier with how they launder money through crypto. Even worse, many exchanges aren’t equipped to catch them in the act.

- The agency uncovered nine crypto platforms linked to some bothersome activities - from financing terrorism to child abuse material on the dark web.

What’s raising red flags? The FIC is particularly worried about:

- Transactions hiding behind anonymous accounts

- Wallets mysteriously connected to multiple payment cards

- Customers who suddenly deposit way more than usual

- Funds bouncing quickly between different crypto types

- Money coming from sketchy mixing services that blur transaction trails

The FIC’s action points: The agency also said crypto exchanges must implement strong KYC procedures and better match transactions to the actual identities of those initiating them.

- Authorities are currently prosecuting a South African national for a bitcoin payment he made to a terrorist organization in 2017.

Zoom out: Since 2022, South Africa has made it clear it’s serious about regulation — and if you’ve been keeping up with this newsletter, you’ll know this crackdown didn’t come out of nowhere.

Kenya is finally drafting crypto rules

Ifeoluwa Awowoye / Mariblock

Topline: After years of a “see no evil” approach, Kenya is finally getting serious about crypto. The National Treasury handed lawmakers the Virtual Assets Service Providers (VASP) Bill 2025 on April 4, aiming to bring some order to Kenya’s crypto scene. (Details)

The details: According to the bill, the Kenyan National Treasury wants VASPs to be brought under the regulatory purview of the Kenyan Capital Markets Association and the Central Bank of Kenya.

- Crypto exchanges must get licensed, open physical offices, and implement anti-money laundering checks. They’ll also need to collect user info and share it with authorities when required.

Key context: This is quite the turnaround from 2015, when Kenya basically told banks to stay far away from anything crypto-related. What changed?

- The explosion of crypto activity in the country made it impossible to ignore, especially after the controversial Worldcoin launch and several high-profile scams burned many Kenyans.

- Last year, the government had already dipped its toes in the water with that 3% digital asset tax that nobody was thrilled about. Now they’re going all in with proper regulation.

Nedbank to roll out smart contract technology within the next 12 months

Omowunmi Babalola / Mariblock

Topline: Nedbank, a traditional South African finance institution, will debut smart contract applications to demonstrate its blockchain capabilities within six to 12 months. (Details)

Be smart: Smart contracts are digital agreements stored on a blockchain that automatically execute when predefined conditions are met.

The details: Corbus de Bruyn, head of client value proposition at Nedbank, told local media that the bank has acquired smart contract technology and is working to deploy it soon.

- Agriculture seems to be their first target. De Bruyn believes smart contracts could revolutionize farming operations by automating imports, exports, and trade processes that currently require mountains of paperwork and human intervention.

- He added that it can also help the bank fast-track the credit financing process, making it easier for borrowers to receive loans as soon as the preconditions are met.

Zoom out: Nedbank isn’t the first South African bank to flirt with blockchain. Absa CIB has already implemented blockchain for digitizing letters of credit, while First National Bank is developing a system for digital title deeds.

One Take from Sidebar

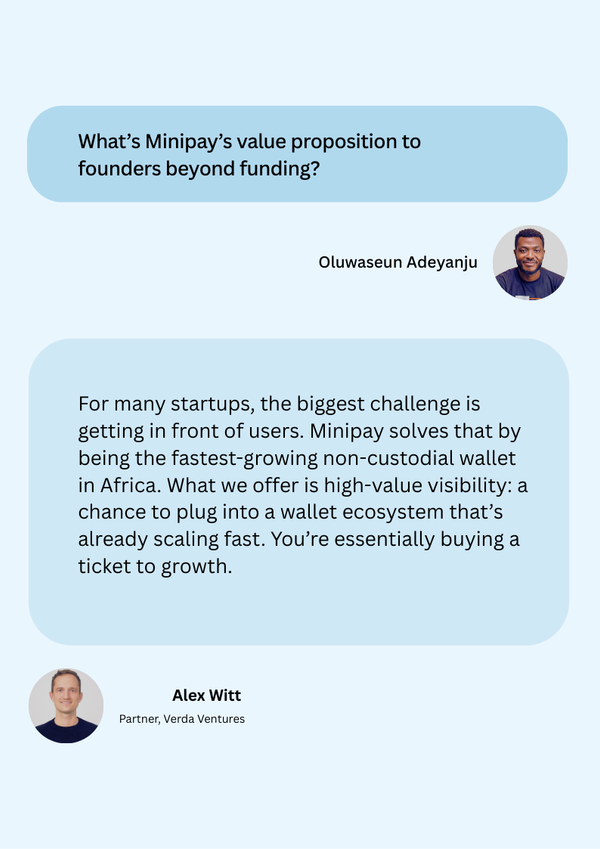

In our second edition of Sidebar, a Q&A series spotlighting voices shaping Africa’s blockchain future, we spoke with Alex Witt, of Verda Ventures, about the $40 million Minipay fund his firm manages and the firm’s broader strategy.

Catch up

🌍 HRF grants four African projects in Q1 2025 (Mariblock)

🇰🇪 Ripple donates 25,000 RLUSD stablecoin to provide drought relief to Kenyan herders (Mariblock)

🇳🇬 CNGN’s developers seeking listing on Yellow Card and Roqqu (Mariblock)

Opportunities

- Sign up for Bybit Academy via AltSchool Africa here.

- Mento Labs’s Global Stablecoin Hackathon is now open till May 2. Sign up here.

- Web3bridge cohort XIII registration is now open till April 15. Register here.

That’s all for this week!

If you found this helpful, please forward it to a friend or colleague—or share it online.

Till next week,

Ogechi.