StarkWare, the developer of Starknet, an Ethereum layer 2 network, has announced a $4 million fund to support blockchain startups in Africa.

The fund aims to support developers in creating projects on the company’s Ethereum layer-two scaling protocol, Starknet.

Investment focus and eligibility

- Morocco-born entrepreneur Kheireddine Kamal is heading the fund, which aims to invest in six to eight early-stage projects annually.

- Speaking during Starknet’s community call on Feb. 3, Kamal said that the fund will prioritize two-founder teams with a mix of business and technical expertise, whose projects have moved beyond the ideation stage.

- Eligible startups should have teams of one to five members and must be committed to developing real-world products exclusively on Starknet.

- The fund will prioritize startups in Francophone West and Central Africa, East Africa, Nigeria, and Ghana.

Key quote

- Announcing the development in a blog post on its website, StarkWare said:

“The Africa investment team will focus on early-stage teams, particularly those at the pre-seed and seed stages, with an emphasis on projects aiming to deploy their solutions on Starknet, the zero-knowledge (ZK) rollup massively scaling Ethereum.”

Funding details

- New startups looking to validate their ideas can secure grants of up to $150,000, disbursed in KPI-based tranches. Teams further along in their startup journey may receive up to $500,000 in investments and equity funding.

- Selected projects will also receive mentorship from experienced founders and gain access to experts in HR, marketing, and other business areas through Starknet.

- The funding program includes a 12-month accelerator, aimed at helping startups grow into independent, self-sustaining businesses.

Zoom out

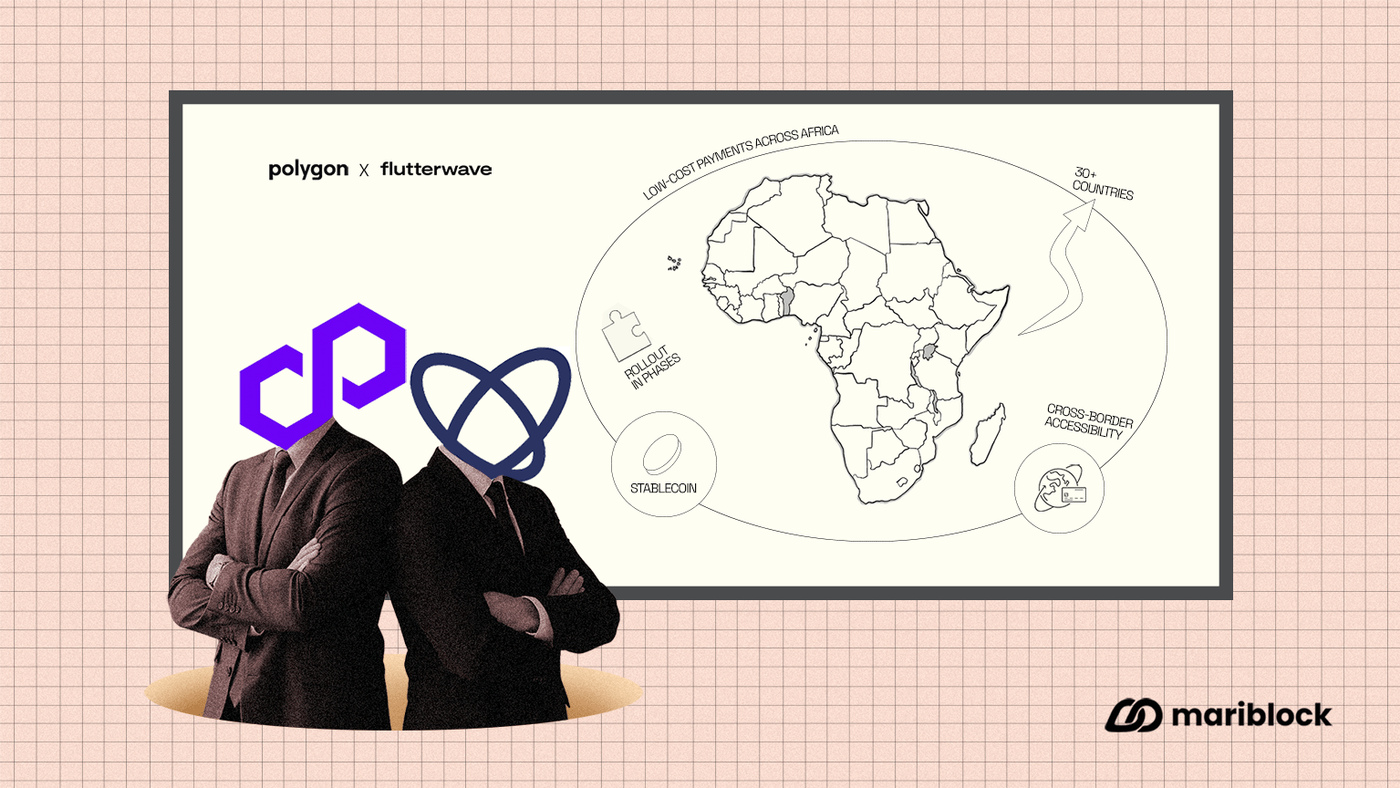

- African blockchain founders have struggled to attract significant funding opportunities over the years.

- In 2023, African blockchain companies only received 6.4% of global venture funds, and only 1.8% in the first half of 2024.

- The funding crunch is attributed to factors such as regulatory complexities, market fragmentation, and a consumer base with low income and spending power.

- Despite challenges, some blockchain firms continue to invest in African startups.

- Between January and September last year, the Ethereum Foundation through its Ethereum support program gave grants to 10 African blockchain projects.

- Blockchain firms usually provide grants and investments to projects built on their blockchains to encourage adoption.