ℹ️ Editor’s note: This story is part of Mariblock’s “State of Fiat” coverage. Digital assets such as bitcoin are seen as competitors to central bank money. Therefore, we consider informing our audience of the state of their local currencies worthwhile.

The Nigerian National Petroleum Corporation Ltd. (NNPCL) said on Aug. 16 that it has secured a $3 billion emergency crude repayment loan from the African Export-Import Bank (Afreximbank) to help strengthen the naira and stabilize the foreign exchange (FX) market.

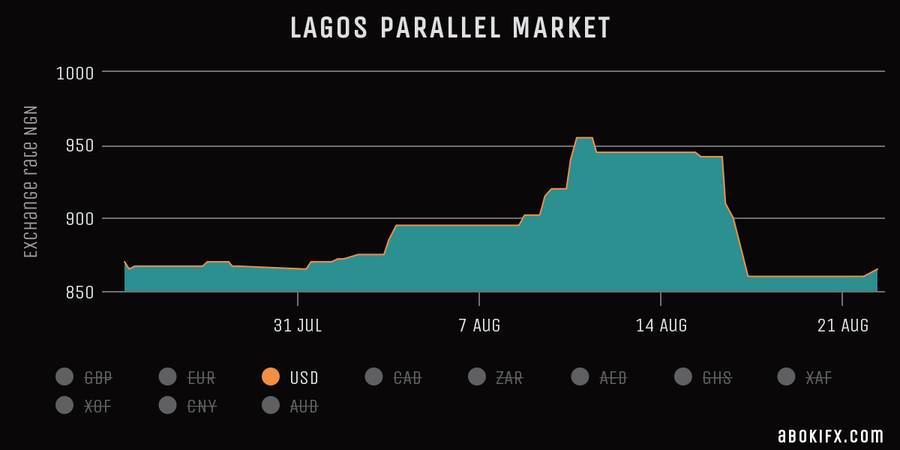

One week following the announcement, the naira has maintained its gains against the dollar in the parallel market — trading at about N860 to the dollar compared to roughly N945 before the announcement.

Mariblock

More on the $3 billion loan

- The NNPCL and Afreximbank signed a commitment letter and term sheet on Aug. 16 to finalize the deal at the Afreximbank’s headquarters in Cairo, Egypt.

- In a public statement, the NNPCL said it will use the funding to support the federal government’s ongoing fiscal and monetary policy reforms to stabilize the foreign exchange market.

- Ajuri Ngelale, a special adviser to President Bola Tinubu, wrote on the social media service X (formerly Twitter):

“This new FX accretion is to enable NNPCL defray taxes & royalties in advance and provide the FGN w/ USD liquidity to stabilize NGN via incremental releases based on FGN needs. Stronger NGN = Lower Fuel Costs. This is a major buffer against the need to re-engage in [the] subsidy regime.”

- The funds will be disbursed based on the specific needs and requirements of the federal government.

- O’tega Ogara, senior special assistant to the president on digital and new media, wrote that the loan will be repaid through a fraction of future crude oil production proceeds.

“It’s a strategic move that ensures a balance between our current economic needs and future production capabilities.”

- The touted benefits of the loan include a stabler naira due to better dollar liquidity and a reduction in fuel costs as the naira further appreciates.

Of note

- In June, the Central Bank of Nigeria (CBN) introduced major reforms to the FX market, allowing the free-floating of the naira.

- This policy allowed prices within the exchange market to be set by the market forces of demand and supply, granting more access to the dollar.

- Still, the naira traded against the dollar at an all-time low in the parallel market, trading at 950 to $1.

- The Nigerian economy has been suffering high inflation, reaching 22.4% in May, according to the Nigerian Bureau of Statistics.