Global blockchain-focused venture capital firm Verda Ventures has announced the launch of a $40 million partnership with the web browser company Opera to support blockchain startups in emerging markets. It is looking to back companies that will build financial products around Opera’s MiniPay wallet launched in Nigeria last year.

The details

- Verda Ventures, announcing the development in a press release, mentioned that it also partnered with Jump Crypto, Borderless Group and Richard Parsons as fellow investors in the fund.

- It added that the Opera-launched MiniPay wallet will be central to its funding drive.

- The MiniPay wallet is a self-custodial dollar stablecoin wallet built on the Celo blockchain and integrated into the Opera browser. It is designed to enable wallet-to-wallet stablecoin transfer across borders using mobile phone numbers.

- Startups that benefit from the MiniPay fund will access the wallet’s framework to build financial products around it.

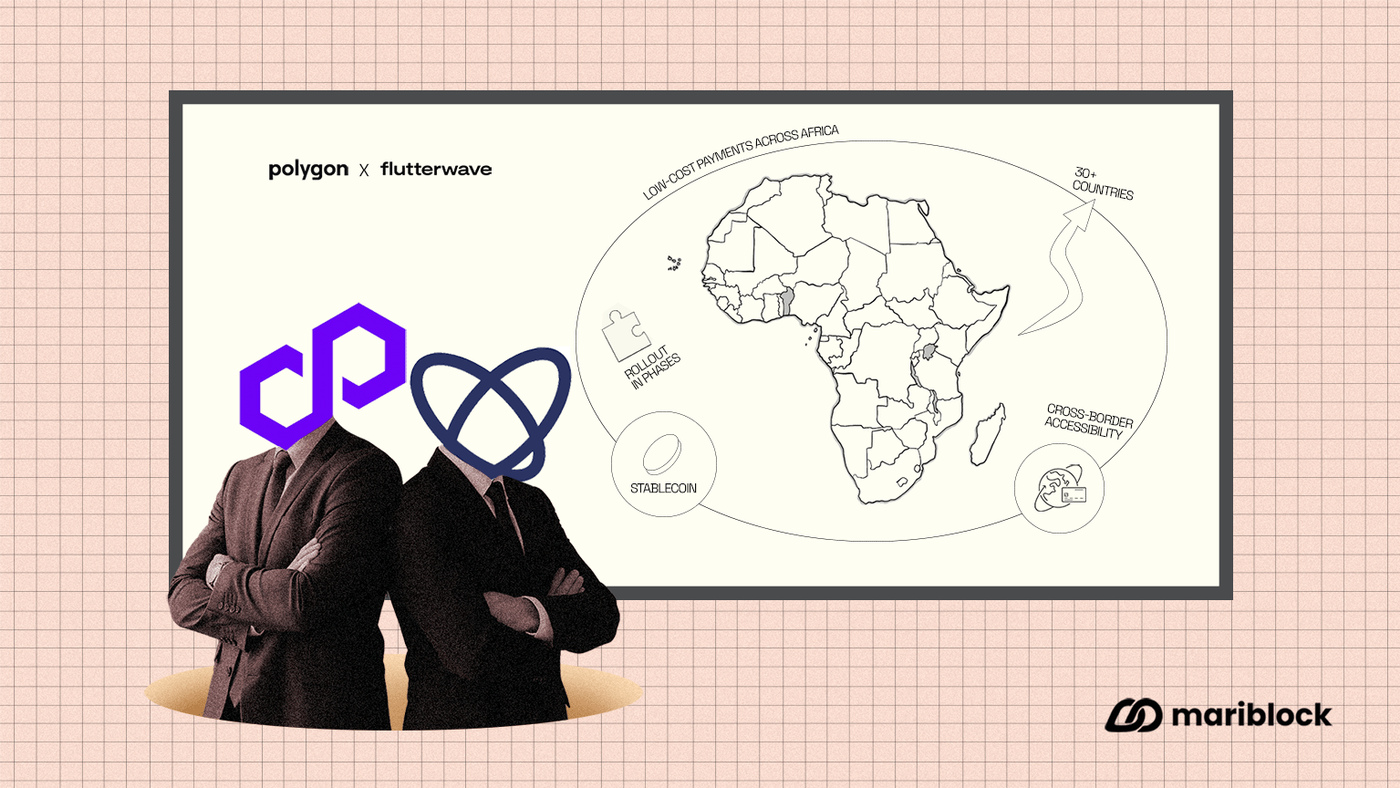

- The fund comes with the incentives of Opera’s distribution network and the resources of Celo and is open to builders building blockchain-based solutions around identity management, remittances and stablecoin banking.

- Per Verda, a few startups have already integrated MiniPay’s infrastructure and are building on it.

Key quotes

- A founding partner at Verda Ventures, Alex Witt, said:

“Partnering with Opera allows us to leverage stablecoin-powered solutions to bridge the financial access gap. MiniPay is uniquely positioned to empower individuals and businesses with essential financial services at a fraction of the cost.”

Why this matters

- African blockchain companies are some of the least funded in the world.

- A report by CV VC found that African blockchain companies received 1.8% of the total global blockchain venture capital funding deals in the first half of 2024.

- However, this report classifies large global companies such as Kucoin and Scroll as African companies merely because they are headquartered in the region.

- In reality, the funding opportunities that trickle down to companies building specifically for African markets are much smaller.

- The MiniPay fund may provide a means for founders building specifically for the African context to access much-needed funding.

- Funds designed to encourage building around specific products are, however, usually established to drive the adoption of these products and their respective blockchains.

- For example, blockchain accelerator, Adaverse, invests in multiple African blockchain companies in a marketing move to drive adoption for the Cardano blockchain.