Jack Dorsey-owned payments company Block has announced the integration of its open-source protocol, tbDEX, by Yellow Card, the pan-African cryptocurrency exchange.

TBD, the web3 software development arm of Block, made the announcement, saying that Yellow Card is the first company to deploy the system in its operations.

Key context

- Earlier in the year, Mariblock reported on a partnership between TBD and Yellow Card to facilitate cross-border transactions across 16 African countries.

- Per TBD’s announcement, the partnership involved Yellow Card integrating the protocol to facilitate real-time transactions from bitcoin to Kenyan shillings paid into an M-Pesa account.

- In its official press release, the company also said that cross-border transactions were only the first use case it considered for the tbDEX protocol.

- The exchange’s CEO, Chris Maurice, told Mariblock that the latest development signifies the full launch of the earlier announced partnership.

Key quotes

- Speaking on the infrastructure, Emily Chiu, TBD’s chief operating officer, said:

“tbDEX bridges the gap between the old and the new – enabling anyone to benefit from decentralized payment systems and digital assets, with easy on- and off-ramps to legacy payment systems and fiat currencies.”

About tbDEX

- At its core, tbDEX is a decentralized and open-source protocol that bridges fiat currencies and cryptocurrencies without needing legacy third-party structures to establish trust among participants.

- tbDEX serves as a platform for exchanges such as Yellow Card and other counterparties involved in a transaction to establish trust.

- It also allows firms to negotiate and confirm the details of a transaction transparently through a bidding system before the transactions and trades are settled outside the protocol.

- In addition, tbDEX incorporates verifiable credentials (VCs) that allow digital claims and physical credentials to be verified in a secured and immutable manner.

- This ensures the protocol adheres to anti-money laundering and countering the financing of terrorism (AML/CFT) guidelines.

Why this matters

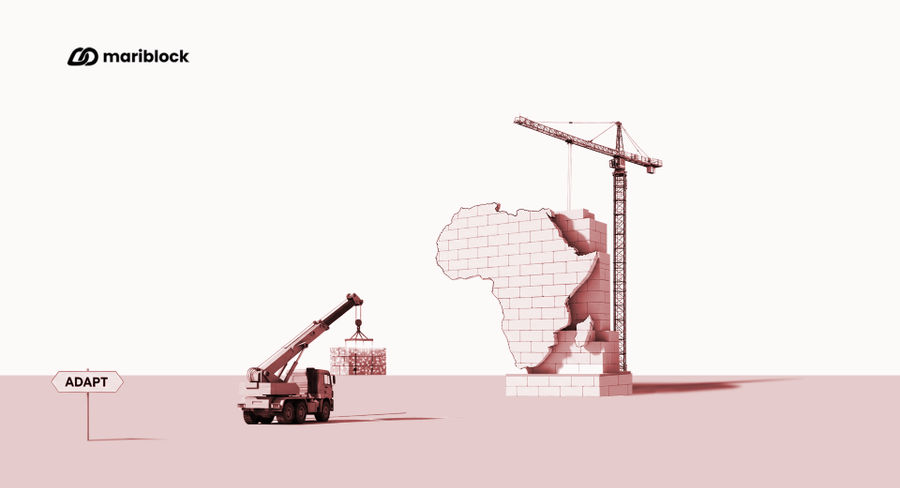

- Cross-border transactions across African countries are still not straightforward and incur heavy transaction fees.

- World Bank figures show that remittances into Sub-Saharan Africa cost an 8.4% fee on average.

- According to the Bank of International Settlements (BIS), a major contributing factor to the inefficiencies around legacy cross-border payment mechanisms is a lack of trust between the parties involved.

- The bank further suggested that payment solutions built around digital forms of money, such as cryptocurrencies and central bank digital currencies (CBDC), could help mitigate these trust issues.