Welcome to the 50th edition of Mariblock Weekly! 🥳

This is a small but meaningful milestone for us. Thank you for reading, sharing and growing with us as we continue to break down the most critical stories in Africa’s web3 and digital assets space.

Here is to 50 more, or 500!🥂

In this edition:

- 🌍 Mastercard to enable stablecoin card transactions with Moonpay partnership

- 📱 MiniPay is now available as a standalone app on iOS devices

- 🇿🇼 Zimbabwe launches blockchain-based carbon credits trading registry

📌 Don’t miss:

- The Stablecoin Signals section, where we track global stablecoin developments that matter.

- The Catch Up section for other stories you may have missed.

Let’s dive in!

Mastercard to enable stablecoin card transactions with Moonpay partnership

Omowunmi Babalola / Mariblock

Topline: Mastercard has partnered with cryptocurrency payment infrastructure company Moonpay to allow users to transact using stablecoins.

The integration will allow Mastercard credit and debit cardholders to settle payments with select digital assets, further expanding the company’s involvement in blockchain-based financial services. (Details)

Key details: Users can now settle transactions with stablecoins like USDC using MoonPay’s infrastructure.

- This is powered by Iron, a stablecoin payments firm recently acquired by MoonPay.

- Iron’s APIs will connect Mastercard to millions of wallets across crypto exchanges.

- The feature will roll out globally everywhere Mastercard is accepted.

Why this matters: Traditional finance is leaning into stablecoins. Stripe recently reported stablecoin transactions from over 30 countries in one week, more than its total Bitcoin volume from 2015 to 2016.

- Mastercard’s move signals growing demand for dollar-backed digital assets — and could ease cross-border payments for Africans facing scarce foreign exchange.

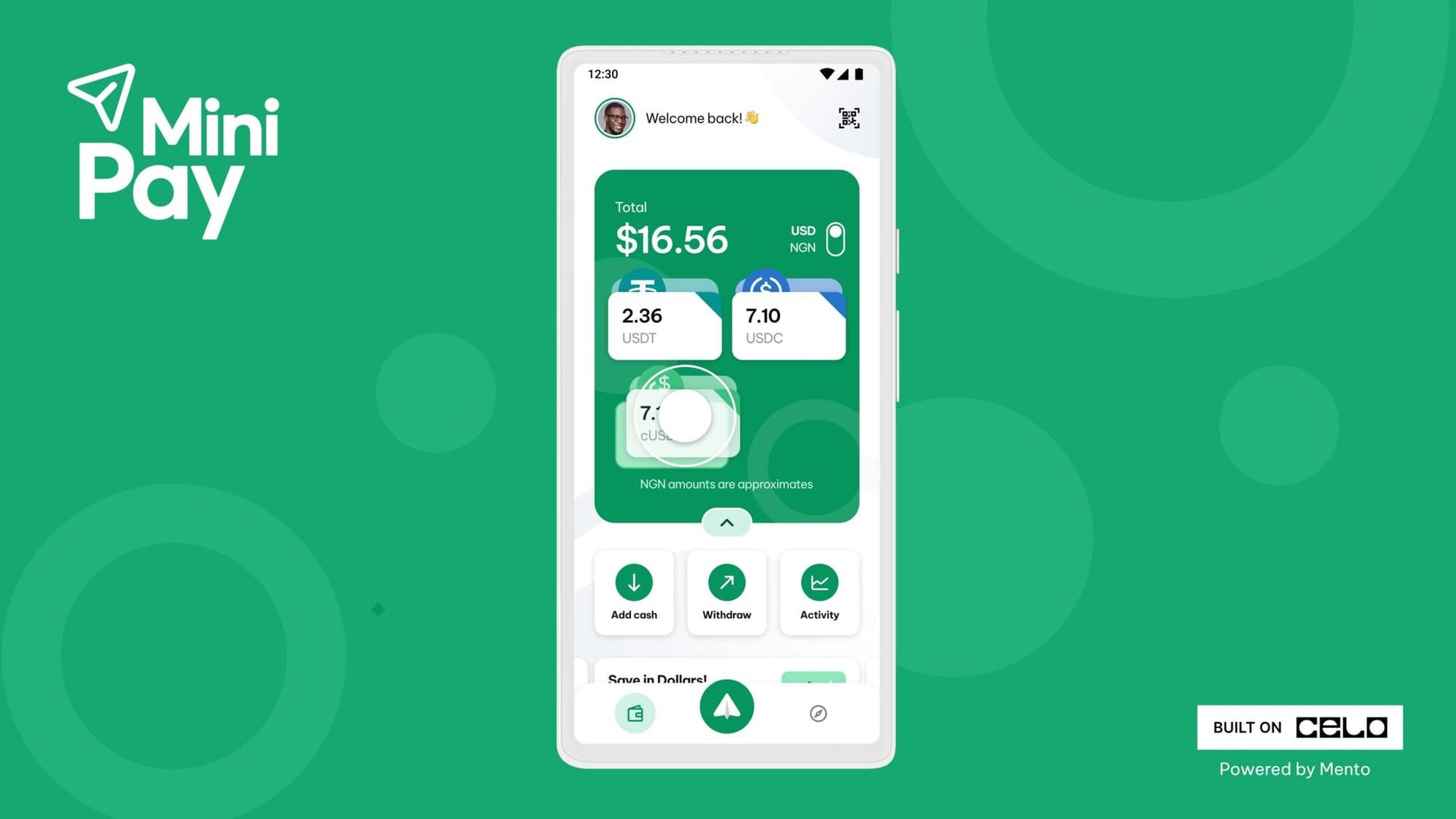

MiniPay is now available as a standalone app on iOS devices

Minipay

Topline: Stablecoin wallet platform built by the website browser firm Opera, MiniPay, is now available as a standalone application on Android and iOS devices. (Details)

The details: MiniPay has reached 8 million users, with 1 million added since launching as a standalone Android wallet in October.

- Built on Celo, the self-custodial dollar stablecoin wallet debuted in Nigeria via Opera Mini in 2023.

- It initially supported only wallet-to-wallet transfers within the browser, but now works independently, broadening access beyond Opera users.

Key quotes: Jørgen Arnsen, executive vice president at Opera, said:

“MiniPay becoming a standalone app is a crucial step in helping people around the world access the global dollar system. Through Celo’s advanced Ethereum L2 network, users can send, receive, spend, and save money anywhere in the world, and then put their funds to use in so many different ways within our growing ecosystem of Mini Apps.”

Zimbabwe turns to blockchain to restore carbon market trust

Mariblock

Topline: Zimbabwe just rolled out a blockchain-powered carbon credits registry in a bid to clean up a mess of its own making and win back investor trust. (Details)

The details: The new registry, hosted on the Ministry of Environment’s website, allows anyone to verify carbon trading project details like registration certificates, project types, and ownership.

- It also displays hash values for key documents, making each entry verifiable and tamper-proof.

- Dubai-based A6 Labs helped design the system, which promises transparency and accountability in how carbon credits are issued, tracked, and traded.

The backstory: In 2023, Zimbabwe abruptly shut down all carbon credit projects, seized 50% of revenues, and demanded all deals be re-registered, citing shady agreements between foreign firms and local actors.

- The move backfired, stalling investments and eroding global trust in Zimbabwe’s carbon offset market.

- This new blockchain registry is the government’s attempt to hit reset and assure partners that carbon credits from Zimbabwe are legit, trackable, and fairly distributed.

Mariblock

Stablecoins are becoming the backbone of digital finance — from cross-border payments to government policy. Each week, we track the most important developments shaping this evolving market for you.

1. One big thing: 90% of institutional players involved with stablecoins

A new Fireblocks survey shows stablecoins are entering the financial mainstream. 90% of firms are taking action, with speed cited as the top benefit over cost. 86% report infrastructure readiness, and regulatory concerns have dropped by over 50% since 2023. Regionally, Latin America leads in usage, Asia sees stablecoins as a growth lever, and North America is shifting from caution to adoption. (Fireblocks)

2. 🇨🇦 Coinbase backs Canadian stablecoin issuer

Coinbase has invested in Stablecorp, the Canadian dollar-pegged QCAD issuer, to expand stablecoin access in Canada. CEO Lucas Matheson says the country’s lack of fast, low-cost payment rails makes stablecoins essential. But adoption lags due to regulatory barriers. QCAD has approximately $175,000 in circulation. Coinbase is urging the government to treat fiat-backed stablecoins as payment tools, not securities. (Cointelegraph)

3. 🇺🇸 U.S. stablecoin bill clears key hurdle

The United States Senate is pushing to pass the GENIUS Act, a bipartisan stablecoin bill, by May 26. Lawmakers removed provisions targeting Donald Trump’s crypto ventures to secure broader support. The revised bill now focuses on consumer protection, bankruptcy rules, and issuer requirements, signaling momentum for U.S. stablecoin regulation ahead of the 2026 midterms. (Coindesk)

➕ More stablecoin headlines

- Northern Marianas passes new stablecoin bill.

- Tether crosses $150 billion in market cap.

- South Korea launches a digital asset committee, and key exchanges will attend the inaugural meeting.

- Report: VCs see stablecoins as crypto’s ‘killer app’

Catch up

🇿🇦 Surprising new information about South Africa’s Bitcoin Brothers (My Broadband)

🌍 U.S. proposes 5% tax on immigrant money transfers and how this affects crypto remittances to Africa (BitKe)

🇪🇹 Ethiopia in the global Bitcoin mining spotlight: AMA with UMINERS (Cointelegraph)

Opportunities

- Sign up for Bybit Academy via AltSchool Africa here.

- The Network School is launching a $100,000 fellowship for founders and creators. Apply here.

- UNICEF Venture Fund is offering $100,000 in equity-free funding for blockchain and frontier technology startups. Apply here.

That’s all for this week!

If you found this helpful, please consider sharing it with a friend or colleague or forwarding it online.

Till next week,

Ogechi.