African crypto payments company Accrue has announced that it has raised $1.58 million in its latest seed round. With the funds, it plans to expand its product offering to other African countries and shore up its team.

The details

- The company, co-founded by former employees of the fintech company, Helicarrier, announced the raise in a blog post commemorating its 3rd anniversary.

- According to the announcement, the seed round was led by the crypto venture firm, Lattice Fund and supported by Maven 11, Distributed Capital and other investors.

- Accrue hopes to drive the expansion of its product across Africa and add members to its team.

How it works

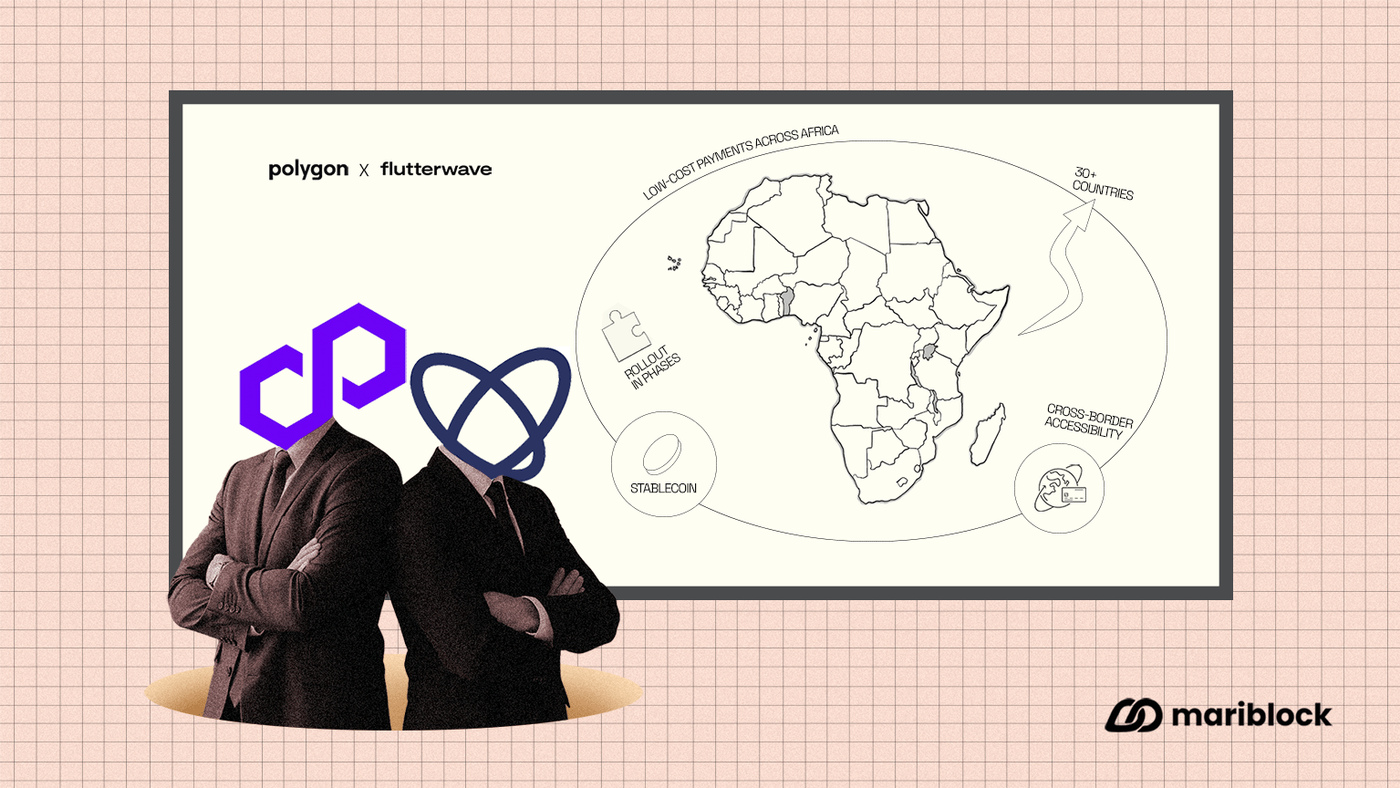

- Accrue runs a platform that allows users to send money to other African countries in their respective local currencies.

- On the back end, the firm facilitates these transactions using stablecoins through its peer-to-peer network of agents, Cashramp.

- These agents deposit stablecoins on Cashramp which functions as an escrow between agents across countries.

- When a user initiates a transaction in their local currency, an agent close to them is assigned, who then collects the fiat payment.

- At the receiving end, another agent completes the payment to the receiver in their local currency.

- The receiving agent then gets the stablecoin equivalent of the fiat payment made from the escrow, Cashramp.

- The firm deducts fees which it shares with the agents.

- Accrue says it has onboarded 200,000 users across the six African countries where it is currently active— Cameroon, Ghana, Kenya, Nigeria, South Africa and Zambia.

Before now

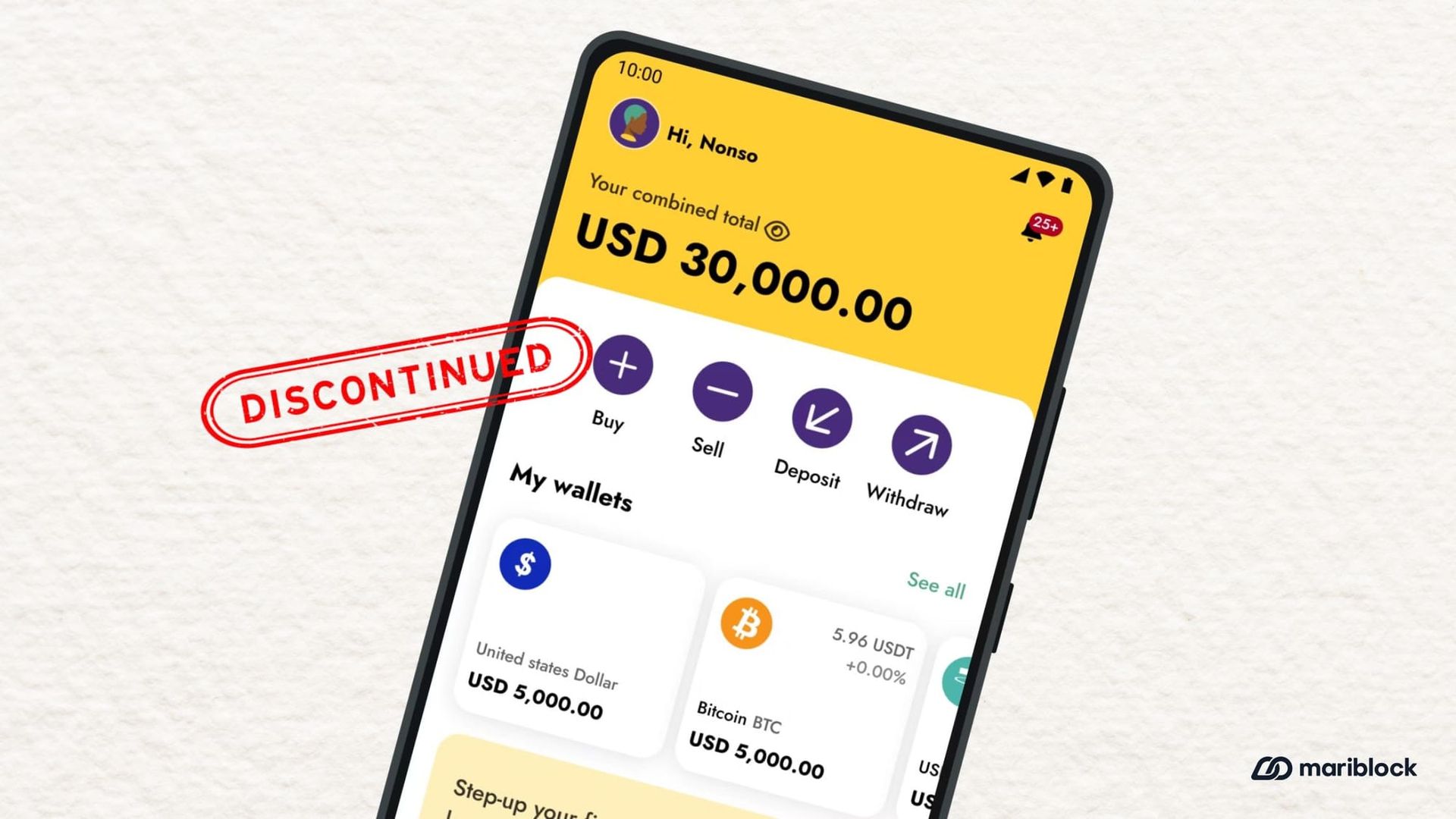

- Accrue, founded in 2021, started initially as a way for users to invest in cryptocurrencies and other investment instruments in a simple way.

- It employed dollar-cost averaging, an investment method that allowed users to invest a lump sum in staggered bits over a period instead of all at once.

- However, following the crypto market crash in 2022, it expanded its services to include cross-border payments.

- Mariblock reported that in the same year, Helicarrier acquired a significant equity interest in Accrue and merged its retail crypto trading service, Buycoins Basic with the platform.