Ponzi and pyramid schemes are still very much alive, as evidenced by the recent collapse of BTCM, a Kenyan-based “crypto mining” Ponzi scheme. Before going offline, the project took in several thousand Kenyan shillings from unsuspecting victims.

How it happened

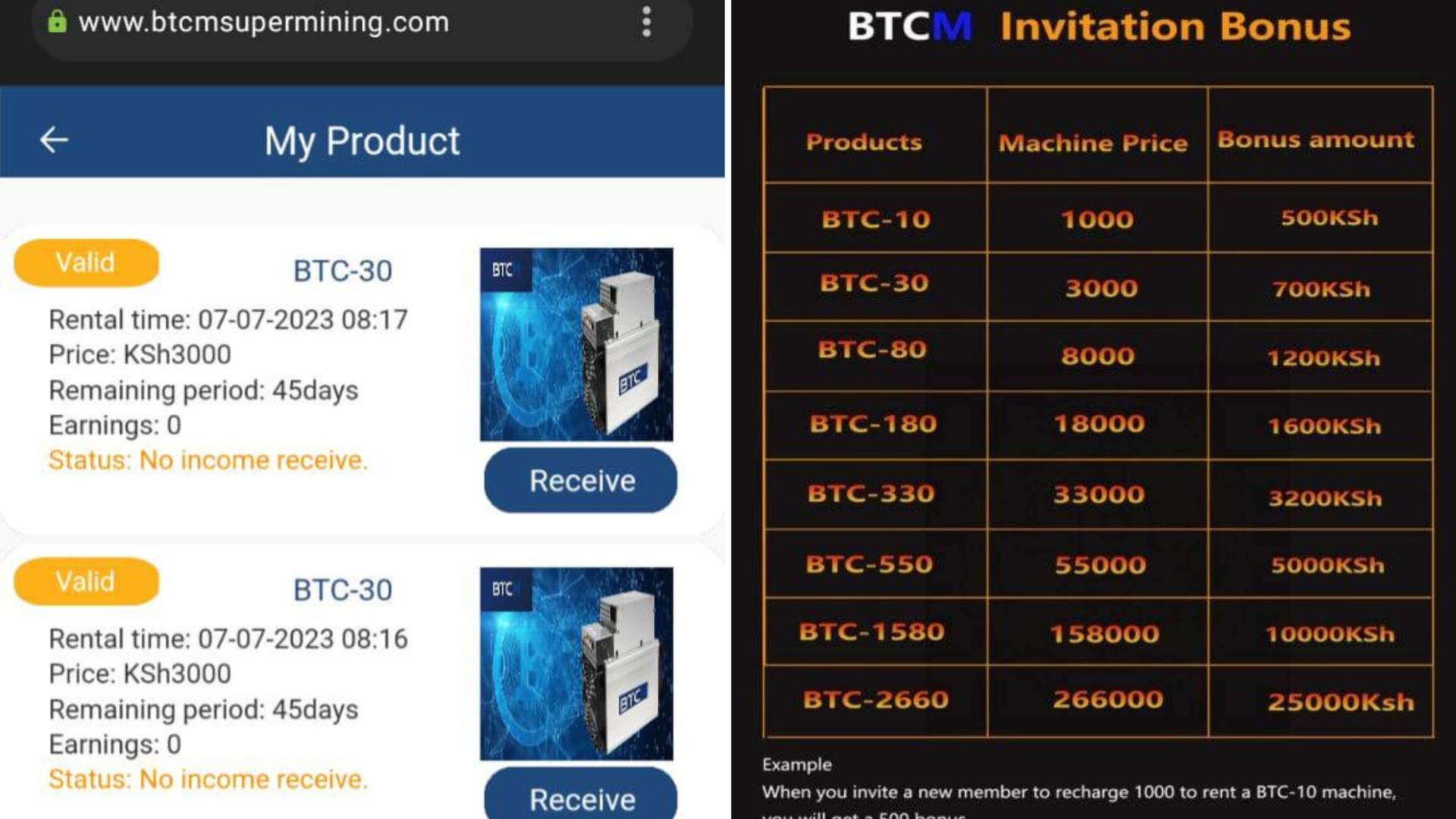

The platform told its subscribers to invest between Ksh 600 and Ksh 266,000 to purchase bitcoin mining equipment and earn as much as 188% to 350% return on investment (ROI) after a few days.

Mariblock spoke to victims who revealed BTCM’s mode of operation. As is common with Ponzi schemes, most victims were invited by friends or family members. A sufferer told Mariblock they were responsible for bringing 46 of their family members and friends into the scheme.

Another victim shared on social media:

“BTCM is supposedly a leading cryptocurrency super mining company...well, at least that’s what...[I] was told, or maybe I trusted my good friend too much...who introduced me to it.”

Be smart: Crypto Ponzi schemes mainly operate identically. In most cases, they impersonate actual companies. For example, BIT Mining Limited (BTCM) is an actual Hong Kong-based crypto-mining entity with no proven affiliation to Kenya’s BTCM, which defrauded several unsuspecting Kenyans.

Screenshots obtained by the BTCM Ponzi sufferers

Some casualties shared evidence that they were paid part of their earnings 72 hours after initiating withdrawals but could not withdraw above a certain amount daily. The 72-hour period would likely allow new members to invest and pay old members with the latest investment.

The last straw came on June 27 when an administrator asked investors for a one-time KSh 6,000 deposit to rein in 300% ROI, KSh 18,000 to earn 320% ROI, 40,000 to get 335% ROI and 90,000 to get 345% ROI, all after 20 days.

Screenshots obtained by the BTCM Ponzi sufferers

According to Mariblock sources, this was the last time anyone heard from them. The platform’s social media page was posted on July 18 but has been silent since then. Victims have taken to the platform’s social media pages to demand their money, but their complaints have gone unanswered.

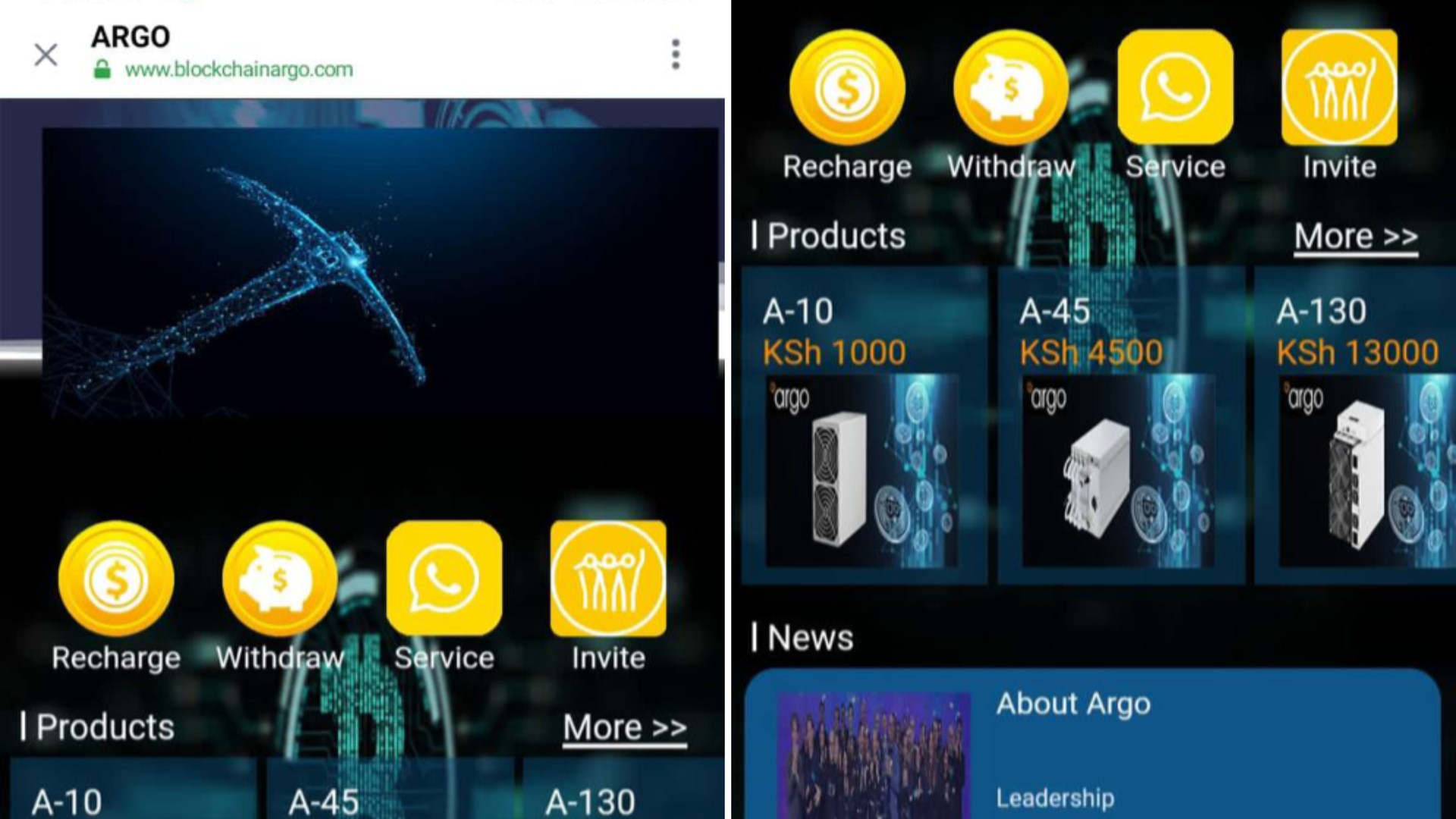

Others claim that BTCM had rebranded as ARGO, a new and identical pyramid scheme asking investors to purchase mining equipment and earn bogus ROIs.

Like the BTCM scam, ARGO Blockchain is a real crypto mining company based in London, UK, with no apparent ties to the new ARGO company asking Kenyans to part with their money.

A screenshot of the Argo Ponzi Scheme website

Ponzi schemes and the quick money promise

Ponzi and pyramid schemes are pseudo-investment schemes that pay investors with money from other investors while claiming to be involved in imaginary investment ventures.

These platforms work as planned in the early days, and even investors who participate early enough get paid as promised. The operators of these platforms mostly do this to gain trust and attract more unsuspecting investors. After a while, they vanish with investors’ deposits.

These schemes are, however, not native to crypto, and Kenya has particularly witnessed a flurry of them over the years. In 2017, a special task force on Ponzi and pyramid schemes established that 271 different schemes existed at one point, with several complaints recorded. It is believed that many more were never reported.

Most notable was the Deci scheme that collapsed in 2006 with over KSh 8 billion (more than $56 million) gathered from 94,000 recorded investors. The scheme’s mastermind, George Odinga Donde, died in 2012, with thousands of victims still seeking repayment. More recently, a former Kenyan cabinet secretary for the Ministry of Information and Communications said Kenyans lost $120 million to several crypto scams in the 2021/2022 fiscal year.

Last year, another scheme named Bitstream Circle went under in a dramatic fashion after promising 5% to 10% daily ROI to over 10,000 members of the company’s telegram group. When the subscribers encountered failed withdrawals and complained to the founders, they were asked to put in even more money to withdraw their investments.

Without suspecting foul play, many obliged, choosing to deposit 10% of their investment. Following this, one of the founders posted several cryptic messages on the platform mocking the investors.

Part of the message reads:

“I still drive my Ferrari, and some of you can’t afford to eat. You are a bunch of brainless races. See you on our next plan.”

A forensic analysis reportedly revealed that it had defrauded people of KSh 1.18 billion (about $10 million) in just 97 days.

Why Kenya?

In a chat with Mariblock, Michael Kimani, the president of the Blockchain Association of Kenya (BAK), said these pyramid schemes are so rampant in Kenya because of a lack of consumer protection framework.

“Generally, I think what is missing is a consumer protection framework, which is difficult to establish because of the policy gaps,” he said. “I think both go hand in hand.”

He added that a lack of information and a poor economy have made Kenyans particularly vulnerable to these schemes.

“The poor state of the economy means people are vulnerable. [It is] easy to fall prey to crypto-branded scams because the crypto industry is real, but bad actors take advantage of vulnerability and misinformation.”