IMF flags stablecoin risks, reiterates need for tighter crypto regulation

The international lender of last resort says stablecoin issuance has grown to $300 billion in 2025, but increased adoption poses financial risks if left unchecked.

The international lender of last resort says stablecoin issuance has grown to $300 billion in 2025, but increased adoption poses financial risks if left unchecked.

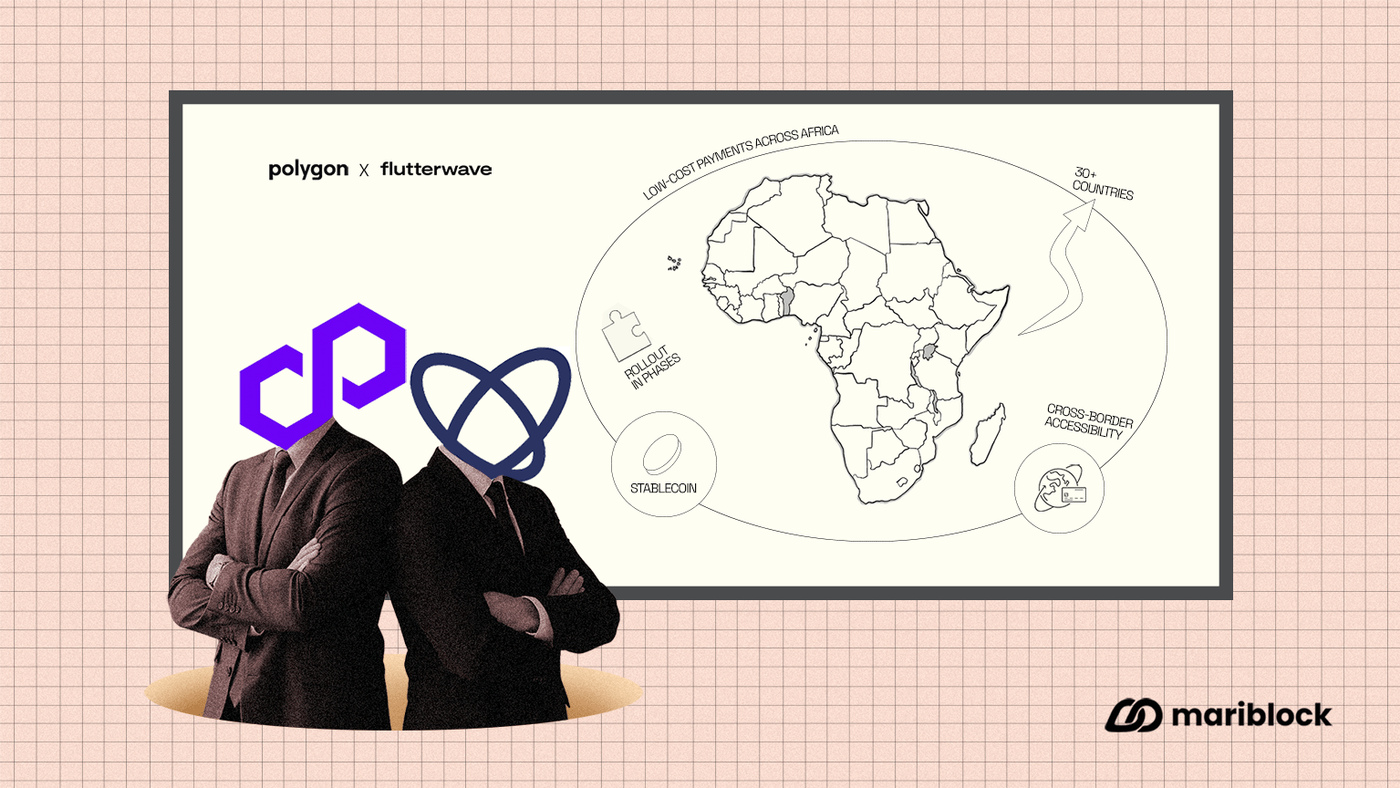

Olugbenga Agboola said rising demand from clients and suppliers already using stablecoins pushed Flutterwave to build payment flows that match how people are transacting today.

Yellow Card told Mariblock that the decision was driven by strong, growing demand for stablecoin-fiat payment services.

Emomotimi Agama said the country is missing out on substantial investments because Nigerians avoid investing in the Nigerian capital market.

While the full rollout is scheduled for 2026, a pilot program of the product feature is expected to run its course before the end of the year.

According the IMF, these countries have lost significant sums of money as a result of being grey listed by the FATF

Ayotunde Alabi highlights how adopting stablecoins and tokenized assets can help Africa build a modern financial system that drives trade and economic growth.

Despite these impressive figures, there is a huge policy vacuum sitting between potential and scale.

The digital currency is backed by Ugandan treasury bonds and can be accessed via smartphones.