IMF flags stablecoin risks, reiterates need for tighter crypto regulation

The international lender of last resort says stablecoin issuance has grown to $300 billion in 2025, but increased adoption poses financial risks if left unchecked.

Stablecoin — coverage and analysis.

The international lender of last resort says stablecoin issuance has grown to $300 billion in 2025, but increased adoption poses financial risks if left unchecked.

SARB said the absence of a complete regulatory framework for crypto assets and stablecoins remains a key vulnerability in South Africa’s financial system.

ADAPT, built in partnership with IOTA and the Tony Blair Institute for Global Change, will allow users to settle trades in local currencies and stablecoins.

Plus: 🌍 Here’s why Flutterwave is enabling stablecoin payments via Polygon

Olugbenga Agboola said rising demand from clients and suppliers already using stablecoins pushed Flutterwave to build payment flows that match how people are transacting today.

Dubbed the ZAR Supercoin, the stablecoin designed and developed by New York-listed Super Group, is backed by cash reserves in Absa bank.

Plus: 🇿🇦 USD stablecoins can undermine African monetary sovereignty — SARB Governor

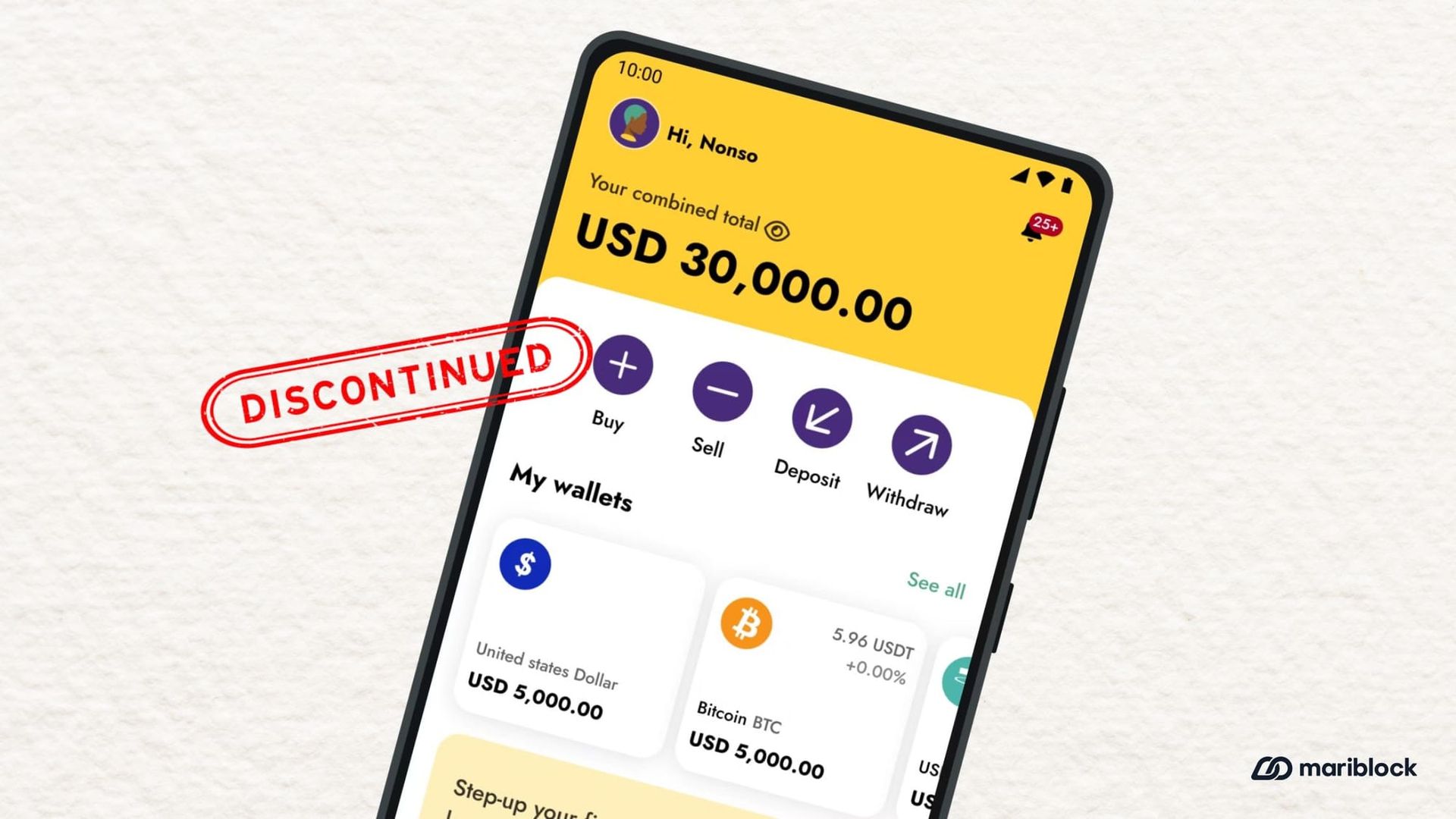

Yellow Card told Mariblock that the decision was driven by strong, growing demand for stablecoin-fiat payment services.

Lesetja Kganyago says he is unconvinced by the supposed stability of USD-pegged stablecoins and believes their backing can be called into question