Zimbabwean economist, George Nhepera has suggested that the government considers paying its civil workers’ salaries with gold coins or gold backed central bank digital currency (CBDC). He advised that these instruments offer a lucrative and competitive edge against the dominance of the United States dollar (USD) in the market.

Key facts

- The purchasing power of salaries denominated in Zimbabwe’s local currency has been significantly eroded due to the country’s local currency depreciation in the parallel market.

- As a result, government workers — who earn in local currency — have demanded to be paid in USD. However, Zimbabwean authorities insist the country does not have enough in foreign reserve to make this sustainable.

- These events have prompted experts like Nhepera to suggest alternatives that the government can choose.

Key quote

Mr Nhepera said:

“To this end, they should be promoted in terms of their use for both people-to-people (P2P) transactions, people-to-business (P2B), and business-to-business (B2B).”

“Once this has been achieved with full market confidence, surely our government can take a giant step to include a portion, say 50 percent of the civil servant salaries and benefits, be paid in these innovative instruments.”

Of note

- Another economist, Morris Mpala, however disagreed with the suggestion to pay civil servants in the gold-backed currency stating that it will reduce the demand for the local currency and as such should not be encouraged.

What was said

Mr Mpala said:

“Let’s pay civil servants the right remuneration and let them have a choice in how they save their money, and we concentrate on making the fundamentals right for everyone.”

Key Background

- Zimbabwe has been using a multiple currency system since 2009, when the Zimbabwean dollar, became devalued due to hyperinflation.

- The multiple currency system allows for the use of multiple foreign currencies, including the US dollar, South African rand, and Botswana pula.

- In practice, the multiple currency system in Zimbabwe has not been very effective in fighting inflation.

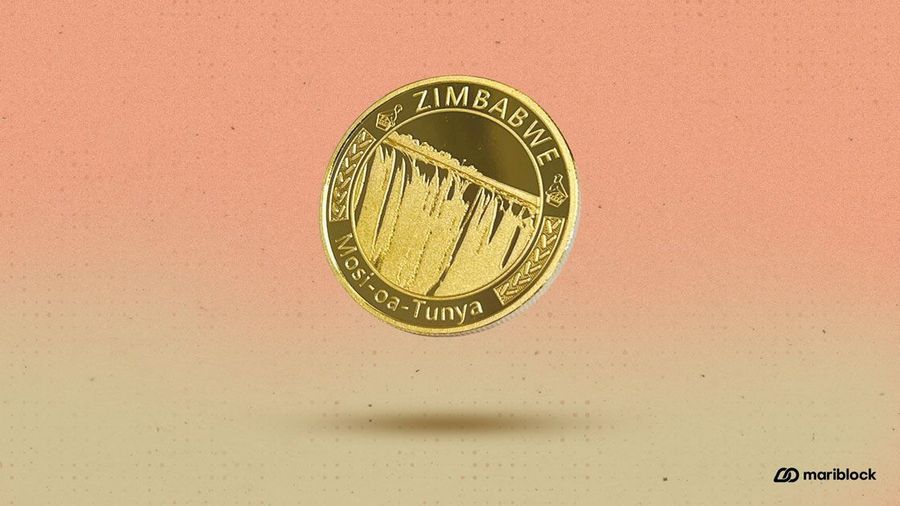

- The introduction of gold coins and the gold-backed digital currency are part of latest measures to ‘save’ the economy and to boost the Zimbabwean dollar that is currently trading at Z$2,000 to $1 on the black market.

- Mariblock reported that a member of the RBZ monetary policy committee told Bloomberg the country would need up to $100 million worth of gold in its reserves to peg the new CBDC to gold.