ℹ️ Editor’s note: This story is part of Mariblock’s “State of Fiat” coverage. Digital assets such as bitcoin are seen as competitors to central bank money. We consider it worthwhile to inform our audience of the state of their local currencies.

Despite improvements in inflation in many African countries, data shows that consumers’ purchasing power remains weakened and continues to weigh on the cost of living in the region. The driving forces behind the persistent inflationary pressures remain the lingering socio-economic issues resulting from the Covid-19 pandemic and bottlenecks in global supply chains.

The fight against inflation continues to be a critical priority for policymakers seeking to stabilize their economies and promote sustainable growth across the continent. African central banks continue to raise interest rates to contain the constant inflation plaguing the region.

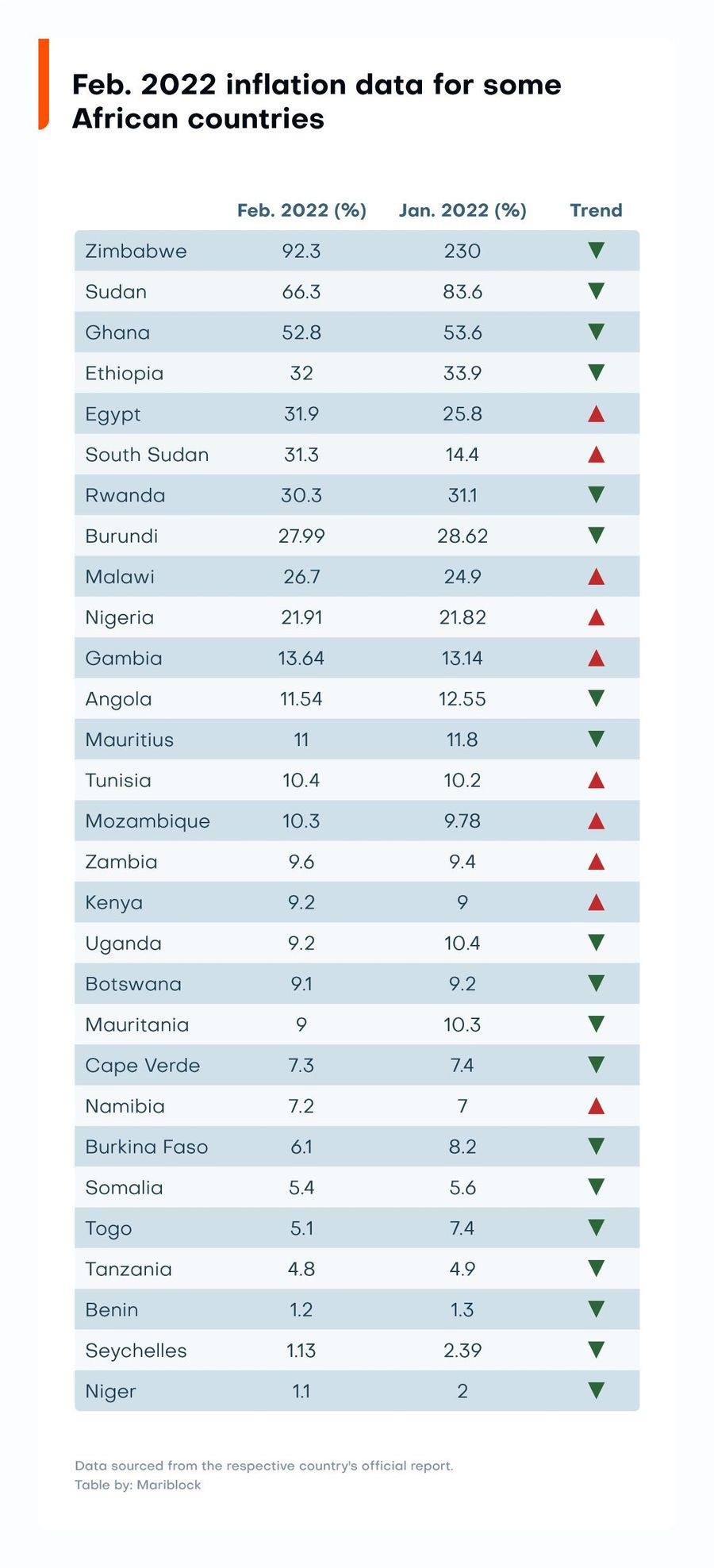

Here’s Mariblock’s February 2023 inflation trend table:

Mariblock

Behind the numbers

Here are highlights of the inflation drivers in some of Africa’s leading economies:

Zimbabwe

- Zimbabwe’s inflation eased to 92.3% in February, its lowest level since March last year, and a significant improvement from the prior month’s 229.8%. The Reserve Bank of Zimbabwe cut its astronomically high-interest rate by 50 percentage points to 150% on Feb. 2 (previously 200%). This was done on expectations that the ameliorating inflation trend — which has been on since September — will continue.

- However, a recent World Bank report has revealed that Zimbabwe continues to lead the top ten countries with the highest food price rise globally. Despite the improving inflation figures in the Southern African country, Rosemary Mpofu, executive director of the Consumer Council of Zimbabwe, said the drop in inflation would not be felt by the citizens as long as prices continue to skyrocket.

Ghana

- Ghana’s inflation eased marginally to 52.8% in February from 53.6% in January and further down from the decade-high 54.2% in December, per the Ghana Statistical Service. In January, the country’s central bank hiked its interest rate by 28% to “help drive inflation on a downward path.”

- The West African country is currently facing an urgent economic crisis, and its local currency, the cedi, has emerged as the worst-performing currency against the dollar — again. Ghana is also in the process of restructuring its debt in the hope of securing a $3 billion loan from the International Monetary Fund (IMF).

Ethiopia

- Inflation in Ethiopia fell to 32% in February from 33.9% in January. In addition to the global supply chain crunch and the economic impact of the pandemic, inflation in the East African nation remains persistent due to implications of extended conflict, drought, flooding, and market disruption.

- Despite the various policy measures introduced by the Ethiopian government — including monetary, fiscal and structural — to curb price escalations, the inflation levels remain in double digits.

Egypt

- Egypt recorded a significant rise in consumer prices — from 25.8% in January to 31.9% in February — exceeding the central bank’s target of 5-9% for one year. The surge is fueled by the fiat devaluation, shortage of the U.S. dollar, and increase in the prices of goods and commodities due to supply chain disruption.

Nigeria

- Nigeria recorded a slight uptick in inflation rates from 21.82% in January to 21.91% in February. That’s significantly higher than the country’s 6% to 9% inflation target.

- According to the Nigerian Bureau of Statistics, food inflation, which contributes to the overall inflation, rose to 24.35% in February, compared to 24.32% the previous month. This is partly attributed to the scarcity of cash caused by the Central Bank of Nigeria’s (CBN) naira redesign policy.

- Nigeria is currently on its longest monetary tightening streak in over a decade, raising interest rates to 18% from 12% between May 2022 and March 2023. Experts surveyed by Bloomberg expect a further 0.5% increase due to President-Elect Bola Tinubu’s plan to remove fuel subsidies and review the multiple exchange rates when sworn in.

Kenya

- The annual inflation in Kenya increased slightly for the first time in four months to 9.2% in February from 9.0% the previous month. According to the Kenya National Bureau of Statistics, food prices contributed to the high inflation, increasing by 1.2% between January and February 2023.

- The inflation rate in Kenya surged past the central bank’s upper limit of 7.5% in mid-2022 and has soared since then. This triggered the bank’s decision to increase lending rates as a measure of control.