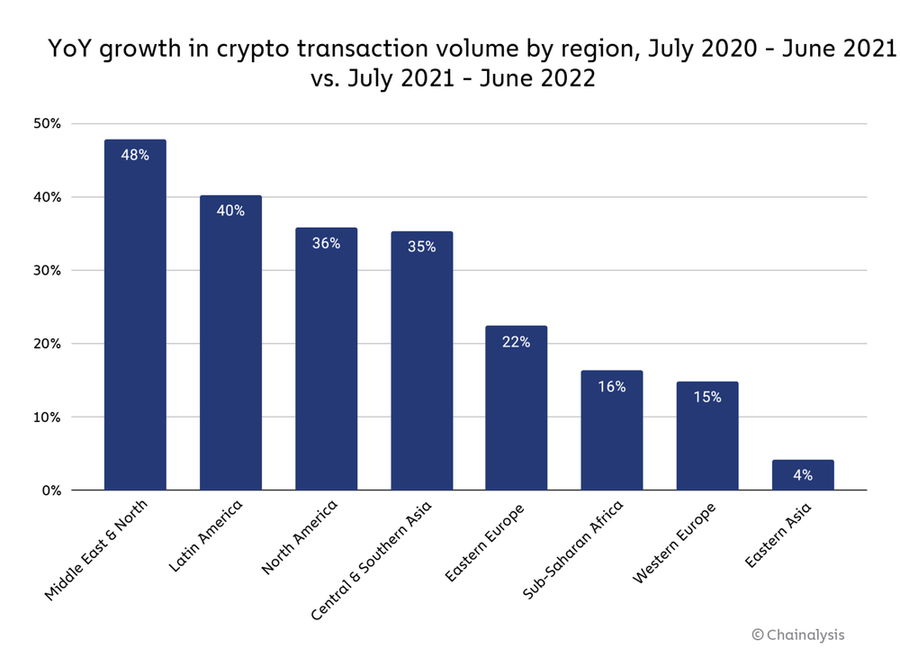

The Middle East and North Africa (MENA) region emerged as the fastest-growing cryptocurrency markets between July 2021 and June 2022, according to blockchain data firm Chainalysis.

MENA-based users received $566 billion in cryptocurrency in that period, 48% more than the previous year. Chainalysis named savings, remittance payments and lenient crypto regulations the top reasons for the region’s growing crypto adoption.

Source: Chainalysis

Driving the news

- MENA countries — Turkey, Egypt and Morocco — are among the top 30 in Chainalysis’ 2022 global crypto adoption index, with the trio coming in at 12th, 14th and 24th, respectively.

- The MENA region contains between 19 and 27 countries, depending on the entity doing the categorization.

In Egypt

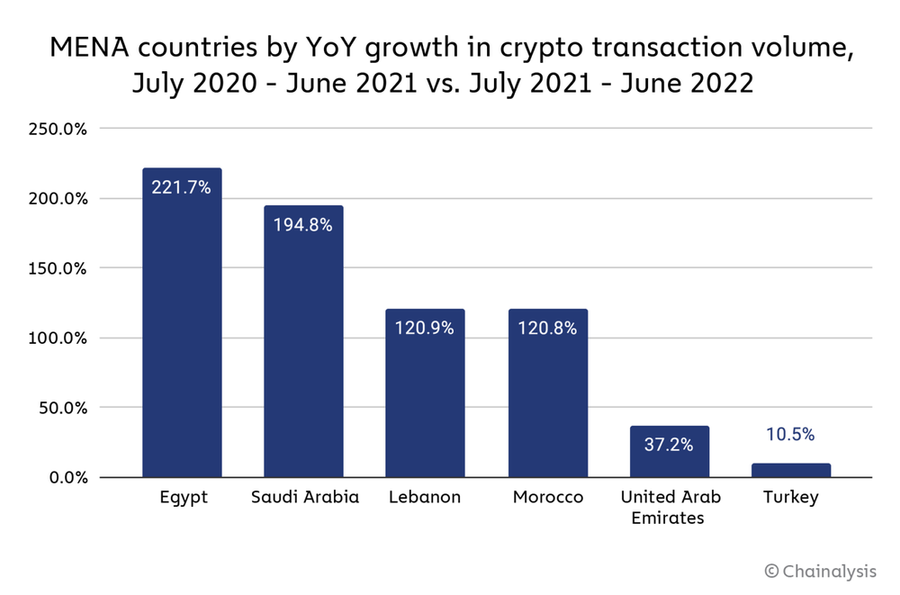

- Crypto transaction volume in Egypt tripled (221.7%) between July 2021 and June 2022 compared to the previous year. This growth rate makes the North African country the fastest-growing market in the MENA region based on transaction volume.

- Egypt has been dealing with currency devaluations, with the Egyptian pound weakening by 13.5% over the past year, reinforcing the allure of crypto savings preservation vehicle.

- As reported by Mariblock, The Egyptian government, however, remains adamant that there’s no place for cryptocurrencies in the country.

Source: Chainalysis

In Morocco:

- Chainalysis cited the cause for gaping levels of grassroots adoption to be the government’s current permissive crypto stance.

- Earlier this year, Morocco’s central bank reviewed its 2017 policy that declared fines and penalties on crypto transactions in the country. It partnered with the International Monetary Fund (IMF) and the World Bank to create crypto regulations with an emphasis on innovation and consumer protection.

In the Middle East

- Saudi Arabia emerged as the third largest crypto market in the Middle East, with United Arab Emirates (UAE) coming in fifth place.

- Chainalysis found that the metropolitan city of Dubai in the UAE has become a hub for crypto companies with customers across Asia and Africa.

- Akos Erzse, Senior Manager for Public Policy at the Dubai-based crypto exchange BitOasis, explained that the main drivers of crypto adoption in the Golf Cooperative Council (GCC) differ from those in the rest of MENA.

Vital Quote

“When you look at markets in the GCC, we take the view that this adoption is driven by young, tech-savvy early adopters with relatively high disposable incomes, that are, you know, searching for investment options, and have a conviction in crypto right now,” said Erzse.

- Erzse also cited the role of inflation in increasing crypto adoption, saying that the interest is not limited to retail clients or consumers but also investors.

- Afghanistan, which ranked 20th in Chainalysis’ 2021 crypto adoption index, lost its place since the Taliban takeover in August 2021. The Taliban government has likened cryptocurrency to gambling and effectively called it haram.

- From November 2021 till date, Chainalysis found that the on-chain value received by Afghan users has averaged less than $80,000 a month from $68 million received before the takeover.