Welcome to Mariblock Weekly, where Nigeria’s new regulated stablecoin, cNGN, has caught our attention. This is another first for Nigeria: cNGN is the first regulator-approved stablecoin on the continent.

The question on everyone’s minds is, will this one gain adoption?

More in this edition:

- 🌍 StarkWare launches a $4M fund for African blockchain startups.

- 🇿🇦 South African startup 6DOT50 now lets you buy cars with crypto.

- 🌍 Africa Tech Summit: Connect with our founder, Oluwaseun Adeyanju, at ATS.

Nigeria’s first regulated stablecoin goes live

Mariblock

Topline: The cNGN, a naira-pegged stablecoin, launched last week and is now available on the provisionally licensed exchange, Busha, and the cNGN platform. (Details)

- cNGN is issued by Wrapped CBDC under the oversight of the Africa Stablecoin Consortium.

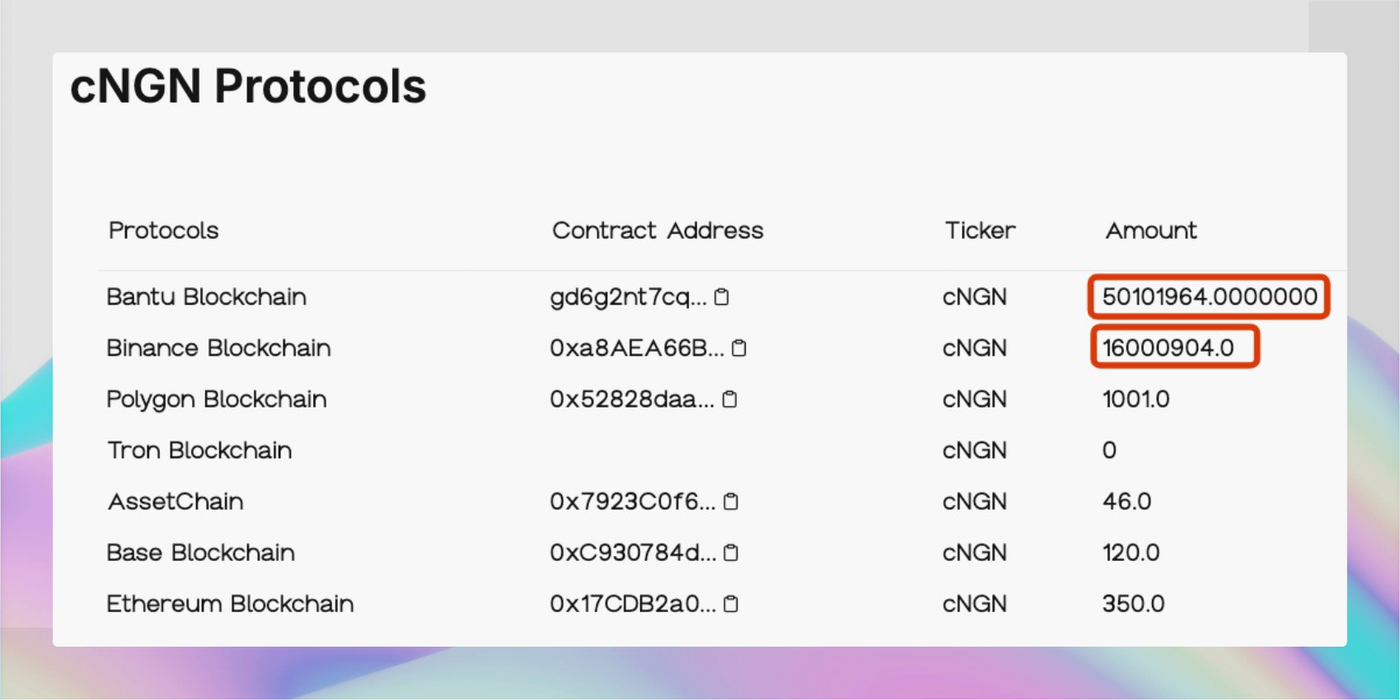

- As of Feb. 9, 66.1 million cNGN tokens were in circulation, distributed among 18 holders. As the image below shows, the little-known Bantu blockchain currently holds over 75% of the total cNGN supply.

Source: cngn.co

Of note: Wrapped CBDC was one of the seven entities to which Nigeria’s Securities and Exchange Commission granted provisional licenses last year.

eNaira vs. cNGN: While both cNGN and Nigeria’s central bank digital currency, the eNaira, are digital assets backed by the naira, cNGN is issued by a private entity—similar to U.S. dollar-pegged stablecoins like USDT and USDC.

Why this matters: Nigeria was first to the CBDC scene in Africa, launching the eNaira in 2021.

- However, it struggled to scale and gain widespread adoption due to technical issues with its makeup, a lack of clear use cases, low consumer trust and poor publicity.

- The big question: Can cNGN gain real traction, or will it struggle like the eNaira — especially given the naira’s notoriety as an unstable currency?

- Of course, only time will tell. But if exchanges adopt it and bake it natively into their platforms for naira-denominated transactions, it will gain some traction.

However, the issuer has its sights set beyond crypto trading, targeting use cases like payments and remittances.

Zoom out: There’s a growing push for local stablecoins in Africa, with industry players advocating for homegrown alternatives to dollar-pegged assets.

- In last week’s edition, we mentioned that Kenya’s Virtual Assets Chamber of Commerce (VACC) proposed a Kenyan stablecoin as part of its policy recommendations to regulators.

- Mento Labs is also actively developing localized stablecoins, including cKES, which is pegged 1:1 to the Kenyan shilling and operates on the Celo blockchain.

StarkWare launches $4M fund for African blockchain projects

Image source: Starknet

Topline: StarkWare, the company behind the Ethereum layer-2 network Starknet, has set up a $4 million venture fund to support blockchain startups in Africa. (Details)

💬 Key quote: “The Africa investment team will focus on early-stage teams, particularly those at the pre-seed and seed stages, with an emphasis on projects aiming to deploy their solutions on Starknet, the zero-knowledge (ZK) rollup massively scaling Ethereum.” Starkware announced.

Investment focus: The fund, led by Moroccan entrepreneur Kheireddine Kamal, will invest in 6-8 early-stage projects annually.

- Eligible startups must have small teams (1-5 people) and be building real-world products on Starknet.

- It prioritizes Francophone West and Central Africa, East Africa, Nigeria, and Ghana startups.

Funding details: Early-stage startups can receive up to $150,000 in grants.

- More advanced startups may secure up to $500,000 in investments and equity funding.

- Selected teams will also gain mentorship and access to industry experts in HR, marketing, and business growth.

Zoom out: African blockchain startups have historically struggled to attract funding, receiving only 1.8% of global venture capital in early 2024.

- This fund could help change that—at least for projects building on Starknet.

South African startup 6DOT50 introduces crypto payment for car purchases

Design by Omowunmi Babalola for Mariblock.

Topline: South African crypto payments company 6DOT50 has partnered with car financing platforms to enable purchases using cryptocurrency at 1,400 dealerships nationwide. (Details)

How it works: Users convert crypto into fiat vouchers via 6DOT50’s platform.

- These vouchers can then be redeemed at participating car dealerships.

- The system currently supports eight cryptocurrencies, including Bitcoin.

Big picture: Regulatory clarity in South Africa has allowed companies like 6DOT50 and CryptoConvert to thrive.

- The Financial Sector Conduct Authority (FSCA) has already issued operational licenses to 248 crypto firms in the country.

- However, cryptocurrencies are still not recognized as legal tender. As such, merchants like Pick n Pay cannot accept cryptocurrency payments directly; they can do so through crypto-to-fiat gateways like 6DOT50 and CryptoConvert.

Connect with Oluwaseun at ATS

Mariblock

Topline: Our founder, Oluwaseun Adeyanju, will be in Nairobi this week, representing Mariblock at the Africa Tech Summit.

- He would love to connect with as many blockchain and digital asset builders as possible.

- Schedule a chat with him using this link.

Coming soon: Mariblock Roundtable 2.0

Mariblock

Topline: The next edition of the Mariblock Roundtable is coming up soon!

- If you missed the Stablecoins Edition in December, you missed profound insights from industry experts on the growing role of stablecoins in driving economic growth and innovation across Africa.

Here’s another picture from the event. We shared one last week.

Fireside chat with MANSA CEO Mouloukou Sanoh | Credit: Mariblock

Here’s your chance to make up for it.

- Details will be released soon, but as a Mariblock Weekly subscriber, you’ll receive the first heads-up. Stay tuned for more updates!

- We’re open to partnerships. Do reply to this email if you’d like to learn more.

Catch up

🌍 Stablecoins are finding product-market fit in emerging markets (Techcrunch)

🌍 Cedar Money, a stablecoin payment platform, raises $9.9 million seed fund (Techcrunch)

🌍 African Billionaire’s X Account Hacked By Crypto Scammers (Forbes)

🌍 Africa is the key to crypto mass adoption(Cointelegraph)

🇪🇹Abu Dhabi’s crypto mining firm Phoenix Group enters Africa with power purchase deal (Reuters/Press release)

Opportunities

- VISA opens applications for Cohort 4 of its Africa Fintech Accelerator Program. Deadline: Mar. 25, 2025. (Details)

- African blockchain talent firm Web3Bridge has opened the waitlist for its 13th cohort. Join the waitlist here.

That’s it for this week.

Until next time, stay informed.

Cheers,

Ogechi.